Consumer durables production at seven-year low

By VJ Media Bureau | Vjmedia Works | January 13, 2014

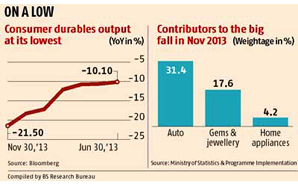

November IIP data show a fall of over 20%, led by automobiles, gems & jewellery and home appliances; turnaround seen as unlikely.

The Index of Industrial Production (IIP) for November, issued this week, shows the production

of consumer durables - which covers a range from automobiles and its ancillaries to appliances, electronics

and gems & jewellery - declined 21.5 per cent over a year, which is also a

seven-year low.

The Index of Industrial Production (IIP) for November, issued this week, shows the production

of consumer durables - which covers a range from automobiles and its ancillaries to appliances, electronics

and gems & jewellery - declined 21.5 per cent over a year, which is also a

seven-year low.

While 2013 has seen notable troughs in the production of consumer durables,

with the index rcording falls of 18.3 per cent in May and 12.1 per cent, 10.8

per cent and 10.1 per cent in October, September and June, respectively,

November is the first month where the decline has gone above 20 per cent.

Key contributors to the decline include automobiles, gems & jewellery and home appliances. Weightage-wise, these categories

contribute 31.4 per cent, 17.6 per cent and 4.2 per cent, respectively, to the

consumer durables index.

Aditi Nayar, senior economist at credit rating agency ICRA, says the

post-harvest (October-November) uptick in demand has been weaker than expected.

"Plus, there was a shadow effect of the situation prevailing in gems and

jewellery. Activity there has been low due to the sharp drop in gold imports,

the basic raw material for that segment. Demand in the auto and appliances

industries, meanwhile, has been weak for a while," she adds.

Passenger car sales fell in 2013 for the first time in 11 years, as customers

continued to defer purchases amid a slowdown. Data from the Society of Indian

Automobile Manufacturers show passenger car sales fell 9.6 per cent to

1,807,011 vehicles from 1,998,703 the previous year. A poor market has

compelled companies to cut production of these on 13 occasions over the past 18

months. November was no exception.

Similarly, home appliance sales (and, therefore, production) in 2013 was

sluggish on account of persistent price increases, due to depreciation of the

rupee against the dollar. According to industry estimates, price rises in

categories such as refrigerators, washing machines, air conditioners (ACs) and

microwave ovens through 2013 was nine to 20 per cent. About 70-75 per cent of

components going into these products are imported, warranting price increases,

manufacturers say.

"I don't see the situation improving

in 2014," says George Menezes, chief operating officer, Godrej Appliances.

"Commodity inflation remains a challenge, with a resurgence seen in Europe

and the US. The rupee will continue to be weak against the greenback and with

the new energy labelling norms kicking in at the start of the current calendar

year, price hikes are inevitable," he added.

The new energy labelling norms from the Bureau of Energy Efficiency prescribe a

two-step and one-step increase, respectively, in refrigerators and

air-conditioners. This means a five-star rated, frost-free refrigerator

launched in 2013 becomes a three-star rated product in 2014, while a four-star

rated split AC in 2013 becomes a three-star rated product this year. To retain

the star rating of their products, manufacturers say price increases of six to

seven per cent will have to be taken to factor in the cost of production. LG,

Samsung and Godrej are said to be contemplating price rises, likely to be

effected soon.

In gems & jewellery, manufacturers continue to operate at half their

capacity, with the scenario unlikely to improve, following recent statements by

the finance ministry that it would not lift import curbs on gold this financial

year. "The volume of imports is less likely to change till the 80:20

principle (20 per cent to be exported against imports) exists. It has capped

imports at 25 tonnes a month," said Sudheesh Nambiath, India analyst, GFMS

Thomson Reuters.

Gold imports for FY14 could be lower by 40 per cent at 515 tonnes against 846

tonnes a year before, experts say. This will be the lowest in 10 years.