FMCG firms, eateries might regain pricing power

July 21, 2016

HUL, Britannia, Nestle & McDonald's have gingerly started hiking prices

Processed food companies and restaurant chains are likely to regain pricing power this year as urban demand revives on the Seventh Pay Commission payout and rural demand picks up with a better monsoon outlook.

Processed food companies and restaurant chains are likely to regain pricing power this year as urban demand revives on the Seventh Pay Commission payout and rural demand picks up with a better monsoon outlook.Hindustan Unilever (HUL), Britannia, Nestle and McDonald's have already started hiking prices gingerly and analysts expect the process to gather steam in the second half of the financial year. These companies have had to postpone price hikes for almost all of 2015 because of weak demand.

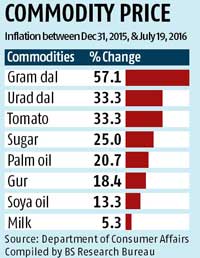

Prices of pulses, tomato, sugar and palm oil have, however, increased by over a fifth since January. Prices of soya oil and milk, too, have increased by 13 per cent and five per cent, respectively.

All these are used in processed foods and detergents and rising prices will have to be passed on to consumers eventually, according to analysts tracking the industry.

"Most established players have long-term supply contracts, which is why they are not facing inflation to the extent visible at the retail level. Farm yields this year are likely to be better, which will bring down prices," an fast-moving consumer goods industry executive said.

Packaged food firms and restaurant chains have tried to delay price rises over the past four quarters. If food prices do not come down in the next two months, consumers may have to pay more. "We expect a gradual return of pricing growth in 2016-17 on a recovery in demand," an Edelweiss Securities report noted.

Packaged food firms and restaurant chains have tried to delay price rises over the past four quarters. If food prices do not come down in the next two months, consumers may have to pay more. "We expect a gradual return of pricing growth in 2016-17 on a recovery in demand," an Edelweiss Securities report noted."We continuously scan commodity markets and take optimal decisions on buying. Price increases are resorted to when necessary to ensure that quality and value to consumer is maintained," a Nestle India spokesperson told Business Standard.

INFLATION PRESSURE

- Increase in prices of various food products might impact raw material costs for major FMCG firms

- Rise in sugar prices to hurt profitability of beverage makers of sugar-based drinks like Colas and juices

- Higher palm oil price to impact margins for soap makers and branded hair oil segment

- Surging tomato and vegetable prices is a cause of concern for ketchup, instant noodles makers

- Quick service restaurant firms same store sales under pressure; could not pass on rise in costs as consumers reduce discretionary spending

- Lower cheese prices has offset the commodity price rise for QSR chains, might impact margins if prices surge post-monsoon

"Market growth slowed down during April-June. Consumer business growth was at four per cent, with a four per cent underlying volume growth, and the operating margin expanded by 70 basis points," an HUL spokesperson said.

A 25 per cent rise in sugar prices since January is affecting the margins of beverage firms, according to an industry executive. Rising prices of sugar in 2015 and a five percentage point rise in the excise duty on fizzy drinks had forced Coca-Cola to hike prices by up to 20 per cent.

Eatery chains, too, are struggling to maintain same-store sales since last year. McDonald's has raised the price of its burgers by 10 per cent.

Advertisement