For a bigger share of the pie

January 25, 2016

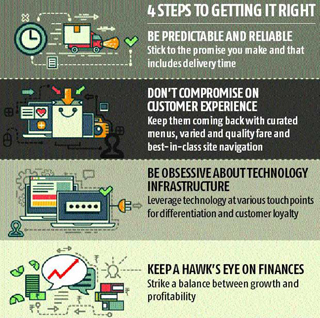

Online food and hyper-local grocery businesses are learning that scaling up - from a few neighbourhoods to many cities and from hundreds to thousands of orders - requires a process approach

The online food and hyperlocal grocery business in India seems to be going through some exciting yet turbulent times. Exciting because following fashion, food and grocery has emerged as the next big thing in the e-commerce space. This space is already crowded. Take plain vanilla online food: there are full-stack players (such as Yumist, Faasos and Eatfresh.com), aggregators (Zomato, foodpanda) and home cooked or chef-curated meal providers (the likes of Holachef). In the online grocery space you have the likes of Grofers, which is grappling with some serious "operation issues", and Localbanya and Dazo that have all but closed down. Many others are struggling to get the right mix of people, processes and product in place to ensure sustainable growth.

The online food and hyperlocal grocery business in India seems to be going through some exciting yet turbulent times. Exciting because following fashion, food and grocery has emerged as the next big thing in the e-commerce space. This space is already crowded. Take plain vanilla online food: there are full-stack players (such as Yumist, Faasos and Eatfresh.com), aggregators (Zomato, foodpanda) and home cooked or chef-curated meal providers (the likes of Holachef). In the online grocery space you have the likes of Grofers, which is grappling with some serious "operation issues", and Localbanya and Dazo that have all but closed down. Many others are struggling to get the right mix of people, processes and product in place to ensure sustainable growth.So, what are the lessons one can learn from the travails of those that are seriously cutting flab? More importantly, what could the survivors do to thrive?

"We have realised that consumers expect a food tech player to address variety, on-time delivery and convenience," says Jaydeep Barman, co-founder and chief executive officer (CEO), Faasos. The biggest issue most players are grappling with is last-mile delivery, Barman says. "Managing logistics is tedious and complicated. Most players in the industry are hesitant to control this area and end up getting a third party on board, which has its own set of complications. Getting the last-mile delivery right is key to controlling consumer experience," he explains.

Faasos, a full-stack player with its own fleet of delivery agents, uses third party logistics only during peak hours. That gives it better control over end-user experience.

For foodpanda, the biggest lesson was to recognise the challenge that the offline market presented. "About 99 per cent of the food ordering market in India is still offline, only a small fraction is online. We're constantly working to get the offline restaurants on to our tech-enabled online platform," says Saurabh Kochhar, CEO, foodpanda India.

To this end, the company has built a proprietary data warehouse that provides in-depth analysis and automated reporting and has introduced a point-of-sale system for restaurants that automates order transmission and menu scanning. "We have introduced a number of proprietary tools to ensure better management of food discovery, order processing and making the delivery experience better," he adds.

These factors are hygiene in ensuring customer loyalty. Says Swiggy co-founder Nandan Reddy, "The entry-level barriers are low and hence, the industry has seen the entry of a lot of players, but most have found it difficult to differentiate themselves. We have learnt that customers are willing to pay for quality and discounting is not the only way to drive loyalty." Prateek Agarwal, CEO, BiteClub agrees. He says, "Spending money on customer acquisition is fine, but if you have to do the same to even retain them, then there is a fundamental flaw with the product where customers fail to see value you are adding to their lives." This brings us to the question, how does one drive loyalty.

These factors are hygiene in ensuring customer loyalty. Says Swiggy co-founder Nandan Reddy, "The entry-level barriers are low and hence, the industry has seen the entry of a lot of players, but most have found it difficult to differentiate themselves. We have learnt that customers are willing to pay for quality and discounting is not the only way to drive loyalty." Prateek Agarwal, CEO, BiteClub agrees. He says, "Spending money on customer acquisition is fine, but if you have to do the same to even retain them, then there is a fundamental flaw with the product where customers fail to see value you are adding to their lives." This brings us to the question, how does one drive loyalty.Pushpinder Singh, co-founder and CEO, TravelKhana.com, believes the two most important things for an average consumer is the quality of food and timely delivery. He says a majority of online food aggregators have suffered as they have failed to exercise control over the quality of food. Taking a cue from international quick service restaurants such as McDonald's and Domino's, Singh has put in place a quality department to ensure the food on offer doesn't compromise on quality. "Our team trains and educates restaurant owners on the quality aspect of food. We also put our partners through regular audits to maintain a certain quality standard."

For Grofers, which has had to suspend delivery in certain locations, a good product backed by unmatchable customer service are key to building a successful business. Albinder Dhindsa, co-founder, Grofers, says, "Ensuring the shortest possible turnaround time (TAT) for our consumers is our goal. The challenge is to set up robust operations and get TAT under an hour. Also, most merchants are not tech-savvy. As we expand operations and add newer categories, we also have to educate our partner merchants." Grofers has integrated merchants with technology-enabled point of sales. It gives the company live feed of the supply and helps plug gaps on a real-time basis.

For Kishore Ganji, founder and CEO, Zip.in, that offers 8,500 products including perishables such as vegetables and fruits, "the consumer experience ends at the customer doorstep. So, it is essential that the product delivered is of high quality". To ensure perishables remain fresh, Zip.in uses trucks with temperature-controlled boxes to limit damage.

Zip.in, like scores of other players, is leveraging technology to improve customer experience at every touch point. Ganji says, "Since our experience is also measured by the fill rate (number of products delivered from an order), we need to be tightly integrated with our suppliers and have clear communication on unavailable products."

For Eatfresh, which boasts a food menu that changes daily, scaling up responsibly is one of the key learnings drawn from competitors. Founder Rajiv Subramanian believes that scaling up - from a few neighbourhoods to many cities and from hundreds to thousands of orders - requires a process approach. "We are building processes into all facets of the business through a technology platform that drives A/B taste testing, recipe database-driven procurement and production, health and safety monitoring (temperature sensors and expiry control), production technology and demand prediction analytics."

P Rajan Mathews, vice-president, marketing and sales, Desai Brothers Food Division, which has recently ventured into the online grocery space with Mother's Recipe, also underlines that serious players need to guard against spreading too thin and fast. "Successful food aggregator Zomato.com picked up as a popular food restaurant listing, later ventured into online food ordering and then to restaurant table booking. This fast and thin spread without establishing a strong base in any aspect has resulted in them winding up operations from many cities and laying off employees. On the other hand, a player like foodpanda.com has only concentrated on the food ordering business and proved more successful at that."

Samarjit Choudhry, director, Vertebrand Management Consulting, cautions brands against reckless expansion. "Players need to take a hard look at this hyper growth. Grow, but at a rate which allows one to build a stable base."

Besides investments to scale up, the cost of delivery is an industry-wide challenge. Subramanian of Eatfresh.com says the company has managed to crack the problem with a simple solution: "We have mitigated this with a full-stack approach where gross margins range between 50-75 per cent. On an order value of Rs 300, a gross margin of Rs 150 is sufficient to pay for delivery costs of Rs 60 per delivery and all other overheads."

That said, Yumist's Abhimanyu Maheshwari, founder and chief operating officer, warns against applying the learnings of other hyper-local services to food delivery, or force-fit other validated hyper-local business models in the food business. Food, unlike other consumable goods, requires completely different handling and safety standards. Speaking from his own experience, he identifies three key elements or areas that need close attention for any player to ensure long-term growth. Rushing into the food delivery business without getting a temperature-optimised supply chain in place is, at best, blatantly wrong, and at worst, blatantly dishonest, he says. Second, hustle engineering does not work: "This sort of customised, perfectly-suited-to-your-model supply chain isn't available over-the-counter, especially in a country like India. One has to build one from scratch while keeping the principles of food-handling intact," he adds. Third, one needs to be conscious of the delivery executive's idle time during the day. That's the single biggest determinant of delivery cost, that is where one makes or breaks the unit economics of the delivery model, he sums up. Sure, all of that requires innovation and oodles of creativity and innovation, but there is no shortage of that in start-up land.

How we are addressing the pain points: Nandan Reddy

We are trying to solve a key problem of logistics in the food delivery space by forming a delivery layer on top of restaurants. We've empowered our delivery executives with smartphones and assign orders to them through a routing algorithm. We are using technology as a key enabler to build a strong service backbone and are deepening the integration with our restaurant partners for more predictability.

We are customer-focused. We are venturing into different service lines understanding the user needs for faster deliveries, curated menu, getting the right restaurants on board, etc. We offer features like live tracking and have a no-minimum-order policy. Differentiation and customer loyalty are key parameters for survival. We have worked on our service quality and app experience to ensure high retention and repeat users.

Nandan Reddy, Co-founder, Swiggy

Advertisement