The new cues to shopper mindset: POPAI

By Press Trust of India | December 10, 2012

POPAI's 2012 Shopper Engagement Study provides compelling evidence about the importance of having - in addition to a strong and integrated pre-store advertising campaign - a robust in-store marketing plan in place to support the ongoing dynamic sales cycle feeding back into the shopper's discovery journey.Â

Traditionally brand marketers have placed significant resource and emphasis on their pre-purchase marketing strategy, but the 2012 Shopper Engagement Study revealed that nearly half (46%) of shoppers utilized pre-store media to plan their shopping trip. Shoppers most often reported using store circulars (29%) or coupons (22%) from the newspaper when planning their shopping trip.

Fewer shoppers are reporting visiting the store without a list of some sort compared to 1995. More than half of shoppers, however, operate without a physical list, making them more susceptible to impulse buys. Few shoppers visit each aisle or section of the store. Over half of shoppers (54%) visit only the aisles and sections they plan to purchase from. Interestingly enough a linear relationship exists between number of aisles visited and percent of basket purchases on impulse, suggesting that shoppers on longer trips enter an exploratory mindset and are more accepting of departures from the shopping plan.

The new shopper journey -- Examining Trip Type, Length, And Party Size

It has long been a daunting task to stay in lock step with the shopper mindset. After all, mindsets are a moving target and can quickly change due to a variety of reasons, including purchase needs and time considerations. These considerations dictate the type of trip, or trip mission, which permeates every aspect of the shopping trip from beginning to end.

The 2012 Shopper Engagement Study found that a majority of the large basket shoppers sampled in this study described their trips as fill in. Average trip length is down since 1995, when shoppers spent 51 minutes in store on stock up trips compared to only 38 minutes today. Approximately three quarters of shoppers are shopping alone when in 1995 only about half of shoppers were doing so. While 91% of those who live alone shop alone, shopping solo is still the norm for shoppers in multiple person households at 72%.

Further complicating time allocation to shopping is the factor of party size and composition of accompanying shoppers down the aisles. Shopper times for females shopping with and without kids are relatively even, suggesting that women have developed coping strategies to stay on track when shopping with little ones. On the other hand, kids elongate the trip for the male shopper.

When looking at shopping party by ethnic demographic breaks the study showed that Hispanic shoppers are most likely to be shopping with others. Among those shopping in groups, Hispanic and African American shoppers are the most likely to be shopping with children (44% and 47% compared to 36% total) and Hispanic and Asian shoppers are most likely be shopping in parties with both adults and children (13% and 16% compared to 10% total)

Nowadays, there is less time to connect with shoppers as they are in a hurry. This means that retailer and manufacturer messages have to be quick so they can be absorbed and methods to convey them have to be more impactful than ever before.

ANATOMY OF THE IN-STORE DECISION - Where Shoppers Are Making Purchasing Decisions

In order to understand today's shopper and better serve their needs, marketers have to first understand how and where shoppers are making a majority of their purchase decisions. To this end, POPAI has developed the in-store decision rate, which dates back to 1965. Purchases are broken down into four different categories and the in-store decision rate is one of the most reliable measures because it is based upon a pre and post shopping interviews -- what the shopper anticipates to purchase versus what they actually purchase.

The four categories that purchases are classified into are:

The in-store decision rate is calculated by taking the sum of the purchases that fall under Generally Planned, Unplanned, and Substitutes categories. Today the in-store decision rate has reached an all time high of 76%. Shoppers are specifically planning less and deciding more at the shelf, suggesting today's shopper is more flexible than ever. Notably, unplanned decisions are down suggesting more pre-store planning at the category level is being conducted. And when shoppers did make an impulse purchase most claimed that the purchase stemmed from remembering that they needed or wanted an item once in the store with taking advantage of a sale as the second most cited reason for making an unplanned purchase.

SPECIFICALLY PLANNED Purchases the shopper specifically identified by name in a pre-shopping interview and bought.

GENERALLY PLANNED: Purchases that were referred to generically in a pre-shopping interview, but not bought by brand.

UNPLANNED : Purchases that were not mentioned in the pre-shopping interview and bought on impulse.

SUBSTITUTES : Purchases that were specifically identified by name in a pre-shopping interview, but actual purchase reflected a substitute of brand or product.

DECISION RATES & DEMOGRAPHICS - How Age and Gender Affect The In-Store Decision Rate

There is no doubt that having the overall in-store decision rate is valuable for brand manufacturers and retailers alike. However, an organization cannot satisfy the needs and wants of all shoppers. To do so would result in a massive drain in company resources, which is why segmentation is a quintessential reality in today's rapidly evolving retail environment.

For manufacturers, shopper marketing is all about targeting. It is about understanding how one's core target consumers behave as shoppers in different channels, formats and retailers, and leveraging this intelligence to develop shopper-based strategies and initiatives that will grow the business (brands, categories and departments) in ways that benefit all stakeholders — brands, consumers, key retailers and shoppers.

For retailers, shopper marketing is all about relevance. It is understanding how one's customers behave as shoppers, either in specific stores (or segments of stores) or as specific shopper segments. It means tailoring platforms, assortments, shelf configurations, in-store environments and in-store marketing and merchandising to best meet the needs of these segments.

These objectives cannot be achieved for all stakeholders unless shopper-marketing initiatives are based on a thorough understanding of how ones' core target consumers overlap with a specific retailer's heavy loyal shoppers, either demographically, psychographically, behaviorally — or, for that matter, all three. In order to provide more actionable segments POPAI has broken out decision rates across categories, by age, and by gender, allowing in-store marketers to activiate these insights as they related to their marketing segements. As the data shows, decision rates are highest for shoppers in the mid thirties to forties and interestingly enough males and females are equally likely to make a decision in store.

UNDERSTANDING TODAY'S SHOPPER -A Look At The Unique Shopper Profiles

When shoppers walk into a supermarket, they do not just reveal where they like to buy their food but also a whole host of lifestyle values, from what they read and watch to what they like doing in their spare time. But as POPAI's Shopper Engagement Study proves, today it is increasingly difficult for retailers and brand manufacturers to shoe-horn their customers into one specific group.

Our predictive shopper profiles contain insights on what shoppers like - based on their stated preferences, their browsing habits, and the products that they actually purchase or abandon in their shopping trips.

Shoppers are clustered into segments to understand the attributes and characteristics that are most important to individuals as they decide where to shop. Shoppers were asked to rate their level of agreement with a broad set of lifestyle and shopping characteristics on a five-point scale. Using factor analysis we are able to create shopper groups based on these lifestyle and shopping statements. These factor groupings form the basis of the creation of shopper segments, which can be analyzed for shopping behavior patterns, price sensitivity, retailer preferences, retailer loyalty, demographic differences, and opportunities for conversion.

These segments have unique attitudes and behaviors as they relate to their shopping patterns and retailer selection. So what shopper profiles have emerged with regards to today's shoppers? The study revealed four basic profiles in shoppers' paths to purchase across all the supermarkets we conducted the study in.

The key shopper profiles

TIME STRESSED -- I need to get in and get out : Shopper who feels pressured from not having enough time and seems to be always in a hurry. Adding to the time pressures are perceived budgetary constraints although this group is not low income.

Skews younger (18-44 and full time employed)

Doesn't use circulars or coupons

Describes self as easily tempted

Likely to be shopping with children

Least consistent use of written list

Second highest percent basket purchased on impulse (70%)

Highest total basket average ($67)

EXPLORER -- I want to be inspired: A shopper who enjoys seeing what new products are available, browsing the store in general and getting inspiration for meals while shopping.

Skews older (55+) and lower income (<45K)

Heavy use of circulars to drive retailer choice

High receptivity to stores with quality private label products as well as per¬ceived variety of product types and package sizes

The most satisfied shopper on for overall satisfaction

Describes self as impulsive and easily tempted

Highest percent impulse basket (72%)

Makes most weekly trips

Spend longest time in store

TRIP PLANNER - My trip is always organized: A shopper whose goal is to get the shopping trip over with and executed according to plan

Skews male and older (55+)

Low circular use

Most retailer loyal

Most consistent use of written list

Not interested in bargain hunting

Describes self as controlled and restrained

Most accurate in predicting total spend

Lowest percent impulse basket (67%)

Fewest number of trips per week

Shortest time in store

BARGAIN HUNTER -- I'm looking for a good deal: A shopper defined by the willingness to shop around for the lowest price

Least retailer loyal

Highest circular use

Highest coupon use

Most likely to use pre store media to

plan trip

The least satisfied shopper on overallsatisfaction

Skews "taking care of the householdâ€

Most likely to NOT purchase an item (s)he planned to buy pre store

Lowest total basket average ($54)

Advertisement

Related Viewpoints

Chanda P Kumar

Chanda P Kumar, Associate Director- Marketing & Communications, Strategy , FRDC

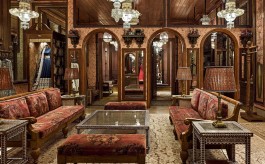

Adding the right sparkle in jewellery store design

Advertisement

Comments