Branded for value

May 25, 2015

Marico wants a slice of the Rs 5,800-crore value-added hair oil market

Remember this popular Bollywood song from the late 1950s that recommended a quick hair oil massage as the cure for all troubles ('Sar jo tera chakraye')? Well, guess what, more than 50 years later, its message has become a hit marketing ploy for oil major Marico. In an age where hair care is largely associated with salons and shampoos, the company is keen to establish the many benefits that hair oils offer: Stress relief, a cool head and a head full of hair, everything that the urban Indian consumer wants to buy into.

Remember this popular Bollywood song from the late 1950s that recommended a quick hair oil massage as the cure for all troubles ('Sar jo tera chakraye')? Well, guess what, more than 50 years later, its message has become a hit marketing ploy for oil major Marico. In an age where hair care is largely associated with salons and shampoos, the company is keen to establish the many benefits that hair oils offer: Stress relief, a cool head and a head full of hair, everything that the urban Indian consumer wants to buy into.Marico wants a slice of the Rs 5,800-crore value-added hair oil market. This is a market that is categorised differently by different players. Market researchers break it down as perfumed hair oils and coconut-based hair oils. The perfumed hair oil (often considered as value added) segment is further broken into light hair oils, cooling hair oils, amla-based hair oils and others by competing players such as Bajaj Corp, Dabur, Emami, depending on the brands they have. While Dabur is strong in amla hair oil with its Dabur Amla and Bajaj Corp leads in light hair oils with its Almond Drops, Emami's Navratna Cool hair oil is the leader in the cooling segment.

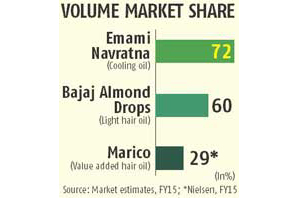

Marico's VAHO portfolio is worth Rs 1,000 crore today. However, its flagship brand, Parachute, is still the biggest revenue earner and has 57 per cent share of the coconut hair oil market while VAHO contributes 22 per cent. In terms of volumes, Marico's VAHO accounts for 29 per cent of the category sales. (see table). It comprises four major brands: Parachute Advansed, Nihar Naturals, Hair & Care and Advansed Jasmine. The annual revenue from each brand is between Rs 250 to Rs 300 crore. The company is focusing on a portfolio of differentiated brands to reach out to the entire spectrum of consumers within one category. For instance, Parachute hair oil caters to the budget segment while the value added portfolio caters to a largely urban, premium consumer segment seeking specific benefits from hair oil.

According to analysts, the company is adopting a de-risked revenue model. The VAHO portfolio is expected to grow faster in the future. Abneesh Roy, associate director, institutional equities-research, Edelweiss Securities, says, "Marico's VAHO portfolio has delivered double digit volume growth for the past four quarters in a row. Their pricing is aggressive in most products and it continues to gain market share from competitors. We believe VAHO's volume growth at 10-12 per cent will be higher than the copra rigid pack which will grow 5-7 per cent."

According to analysts, the company is adopting a de-risked revenue model. The VAHO portfolio is expected to grow faster in the future. Abneesh Roy, associate director, institutional equities-research, Edelweiss Securities, says, "Marico's VAHO portfolio has delivered double digit volume growth for the past four quarters in a row. Their pricing is aggressive in most products and it continues to gain market share from competitors. We believe VAHO's volume growth at 10-12 per cent will be higher than the copra rigid pack which will grow 5-7 per cent." However, Parachute is still the main revenue earner. The company has managed to wean away a large chunk of the loose coconut oil customer base over by reducing the pack sizes and pricing some for as low as Rs 10 a pack.

Marico has launched multi-ingredient hair oils that promise nourishment and non-sticky hair care to consumers and is targeted at young school and college going consumers. Saugata Gupta, the MD and CEO, says, "We are extremely confident of delivering 15-20 per cent growth in our value added hair oils segment. All other players in this segment operate in only one space and one ingredient. While we operate, not on an ingredient base, but on a consumer needs base." Marico is also targeting older customers with products that tackle hair fall. As Gupta says, "Hair fall is one need (that we are focusing on). We are prototyping mustard oil. You will see a significant amount of innovation in this category."

Marico's strategy so far has been to reach out to a broad base of customers, through brand extensions and to keep its risk low with a range of brands within one category. Others have taken a different route; Bajaj Corp, for instance, is largely dependent on Bajaj Almond Drop bringing in 90 per cent of its total revenues. But Dabur and Emami have a host of new launches lined up: Dabur Keratex Hair Oil was launched in the therapeutic segment in the last quarter. Emami has the 7-in-1 hair oil and plans to ramp up advertising expenditure for the brand.

Marico's strategy so far has been to reach out to a broad base of customers, through brand extensions and to keep its risk low with a range of brands within one category. Others have taken a different route; Bajaj Corp, for instance, is largely dependent on Bajaj Almond Drop bringing in 90 per cent of its total revenues. But Dabur and Emami have a host of new launches lined up: Dabur Keratex Hair Oil was launched in the therapeutic segment in the last quarter. Emami has the 7-in-1 hair oil and plans to ramp up advertising expenditure for the brand.Marico's marketing strategy has been different from the rest. It builds prototypes of its products and launches them within a small segment of customers before going for a nation-wide launch. For example, its Parachute Advansed Aromatherapy oil was first tested in Mumbai in the last quarter. It has recently launched Parachute Advansed Ayurvedic Oil in the southern states. Nihar Naturals Shanti Sarson Kesh Tel, too, was prototyped in Rajasthan and will now reach the rest of the country. As per Nielsen data, in FY-15, Marico's VAHO portfolio's volume market share increased 88 basis points to 29 per cent and value market share expanded 210 basis points to 22 per cent. Marico is looking at cornering 30 per cent of the value and 40 per cent of the volumes over the next three years.

For that it would need to invest heavily in market building as well as brand building exercises.

Advertisement