Stop interrupting shoppers!

By Fairy Dharawat | January 15, 2014

Pat McCann, Global Director for TNS Retail & Shopper, tells us that to broaden product consideration and grow sales, category managers and shopper marketers must abandon disruption - and focus on helping shoppers find what they are looking for. Read on…

Retailers and manufacturers don't draw up planograms for fun. And at the risk of sounding cynical, they don't usually draw them up just to make shoppers' lives easier. Their objective is, naturally enough, a more self-interested one: most planograms aim to influence shoppers' decisions, affecting what they buy and increasing the amount that they spend. As such they embody an assumption: that shopper are actually making decisions in-store, considering choices and weighing up options. The problem is that for most shoppers and most purchases, this assumption is very wide of the mark.

Choosing or searching?

TNS has spent more than 20 years observing shopper behaviour. And all of that observation points to one overriding conclusion: for the majority of shoppers, the purchase process has little to do with decision-making; it has everything to do with finding something that the shopper has already decided to buy. Purchasing data show that 69 percent of supermarket shoppers buy the same brand as they did last time they purchased from a category - and 45 percent buy exactly the same product. In case you think this only applies to pre-planned purchases, 66 percent of confectionery shoppers in supermarkets (about as impulsive as supermarket purchasing gets) have already decided on the brand they will buy when they enter the store.

Shoppers spend the vast majority of their time at the shelf searching for the product they know they want - and when they are busy searching for specific products they are not open to influence; in fact, they are effectively blind to anything not relevant to the task in hand. An experiment by'Shopology' proved just how difficult it is to distract shoppers when they are in search mode. Researchers placed a pack of beer in the middle of a cereal shelf and then videoed shoppers' reactions to it. You'd think this was attention-grabbing and disruptive; in fact, hardly any shoppers even noticed the beer. The fact is that when shoppers are in search mode, they don't see what they are not looking for.

The price of disruption

The approach that most category managers and shopper marketers take to this challenge is to interrupt the search and attempt to jump-start a consideration process, inviting the shopper to connect with the category. From a superficial look at shopper behaviour, you'd think this approach works: we see people pausing in front of a category, we watch them scanning the shelf and we assume that they are weighing up different options and thinking through their purchases. But appearances can be dangerously deceptive. When you look a little deeper below the surface, you quickly see that the disruptive merchandising strategy isn't really leading to more open-minded shopping; instead it's creating more frustrating searching - and that is hugely counter-productive for all concerned.

We like to think of shopping as a positive experience, centred on finding solutions to satisfy wants and needs. Searching, on the other hand is essentially negative: shoppers spend their time de-selecting large numbers of products so that they can focus on the ones that they are actually interested in. Eye-tracking may show that a shopper rapidly scans 100 items within a category but if we overlay EEG results, we can see that 96 of them are rejected. And rejection isn't fun. Our shopper only experiences positive emotion on the four occasions when he or she sees a relevant product.

All of this happens very rapidly, and barely consciously, but that degree of negative feeling does affect the shopping experience. The longer a shopper spends looking for a product within a category, the greater the likelihood of them giving up and walking away from the shelf without putting anything in their basket. In fact, on average, 30 percent of grocery shoppers who browse a shelf walk away empty- handed. Our disruptive approach hasn't opened these shopper's minds to other purchases - it's stopped them buying anything at all. Even more frustratingly, 20 percent of the items shoppers have specifically planned to buy don't make it into the basket.

Working with the search agenda

The way to opening the minds of shoppers isn't to interrupt or extend their search; it's to help them complete it; to work with the shopper's agenda rather than trying to change it. At first glance this seems somewhat counter-productive: if shoppers find the item they were looking for quickly won't they just walk away from the category without considering anything else? In fact, TNS's research shows the opposite: shoppers that find their first item quickly are more likely to buy additional items from the same category. When a shopper finds their first item within 10 seconds, the average number of items going into their basket jumps markedly.

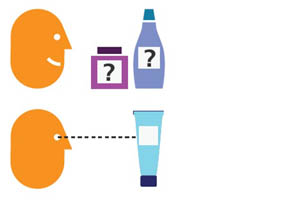

The fact is that within most categories,'decided' shoppers have the potential to become'open' shoppers, but only once the initial search process has been completed quickly and without frustration. Let's take the example of a woman shopping for shampoo. Her everyday family shampoo is her priority and something she buys time and time again. Her choice has been decided long before she entered the store. The faster she can locate it, the more time she will spend considering the benefits of other shampoos in front of her; she may well end up trying a new product or putting more than one option into her basket. If, on the other hand, she spends over a minute looking for her family shampoo, then she will probably walk away as soon as she has it in her basket. And if the initial search takes too long, she might well walk away thinking they can all make do with body wash this week.

When we know that most purchases are decided in advance, we have a clear goal for organising categories to increase sales. The simple fact is that merchandising has to cater to decided shoppers first and foremost.

The science of de-selection

When searching, the decided shopper interacts with the shelf at a category rather than a product level: they scan many products with very rapid eye movements looking for visual cues to help them makes sense of the shelf and narrow their search options. In order to do this efficiently, they need a clear structure where the shelf hierarchy is based on product features and reflects the order of the shopper's search. Research has a vital role to play in helping to identify the product features that decided shoppers prioritise in their search, so we can make them easier to find. By organising the core structure in this way, decided shoppers are able to rule out large numbers of products quickly and move rapidly from search to selection, increasing the likelihood of them considering alternative, or additional, purchases.

When P&G took the bold step of re-organising the skincare category shelves to make them easier for shoppers, the impact on both behaviour and spend was dramatic. Over the next six months, shoppers spent noticeably less time standing in front of the shelf scanning products; instead they identified the products they were interested in from a distance and went straight to that point in the shelf. Significantly though, the amount of time they spent in the category didn't reduce at all. Instead, the extra time saved in not searching for products was spent considering purchases - and considering more of them than before. During the six month period, category sales increased by a staggering 31 percent.

Catering to'decided' and'open' shoppers

Of course, merchandising cannot afford to put barriers in front of shoppers who haven't made a decision - and this means that it needs to cater for open shoppers' selection needs as well. On the face of it this seems a dilemma, since we've already established that increasing sales depends on building the shelf hierarchy around decided shoppers. We only have one shelf to work with, so how can we cater for open shoppers at the same time?

The open shopper's selection isn't completely open; it is based on selection needs that have been established at some point before entering the store. His or her selection process will come down to understanding different product propositions for meeting these needs, comparing them and eventually choosing the one that balances their requirements most effectively. Grouping products that meet similar selection needs, and enabling shoppers to compare propositions easily, doesn't undermine a core shelf hierarchy built around product features; in fact, it supports and strengthens it.

Let's take the example of a mother shopping for breakfast cereal. Her two school-age sons simply want cereal that tastes good. She wants something they will happily eat, but would ideally like a product that offers some nutrition as well. She hasn't made her mind up about which children's cereal she wants, but she has a good idea of the particular consumption needs she is looking to satisfy. If she is able to identify a group of nutritious kids cereals and start comparing flavours to find something that her sons may like, then she will be well on the way to making a decision efficiently. And provided the group of kids' cereals fits within a clear shelf structure, this arrangement won't delay her finding her own favourite cereal that she buys every time she visits.

The role of packaging communication

Similar principles and a similar hierarchy of priorities apply to manufacturers looking to increase share of spend within a category. Once again, it is essential to prioritise rapid visual communication with the vast majority of shoppers who are decided as to the product features they want - and are engaged in rapid, sub-conscious searching. Key product features that are relevant to such a search must be prioritised in the package design and communicated where possible through colour and visual cues, since the product only has a split second to establish its relevance. More specific product benefits that may persuade an open shopper to pick that product over another can be communicated through text, since they have a longer window of opportunity to engage with these shoppers during their consideration process. The pink colour of a packet of prawn cocktail flavoured crisps is a great example of the first form of communication; clear copy stressing reduced fat or increased flavour is a great example of the second.

Principles for category planning

Applying consistent principles based around actual shopper behaviour isn't the same as suggesting a one-size-fits-all solution for category planning. Merchandising will always remain a complex art, in which many different elements are brought together to meet a range of conscious and sub-conscious shopper needs. An understanding of the precise priorities of decided and open shoppers in each category is essential for planning shelf hierarchies and product groupings effectively. However, that planning process can be rendered far more effective at driving growth when it has a clear objective of its own - and the evidence of actual shopper behaviour makes it clear what this objective should be. If manufacturers and retailers want to increase consideration and spend they must organise categories to reduce search time and ensure that decided shoppers find what they are looking for as quickly as possible. In doing so, they will be putting shoppers in control of the time they spend in store - inviting them to spend less of that time searching and more of that time shopping. It's a leap of faith, but one that is long overdue.

About the author: Pat McCann is Global Director for TNS Retail & Shopper, responsible for developing best practice shopper solutions and enhancing shopper insight delivery. She started her career at Nielsen and then worked clientside at Avon and Allied Lyons before joining TNS. With over 20 years experience as a buyer and supplier of shopper and consumer research, Pat was instrumental in establishing this global practice area and in acquiring shopper specialists, Sorensen and ID Magasin.

Advertisement

Related Viewpoints

Chanda P Kumar

Chanda P Kumar, Associate Director- Marketing & Communications, Strategy , FRDC

Adding the right sparkle in jewellery store design

Advertisement

Comments