Price focus trims Nestle volume growth

August 25, 2016

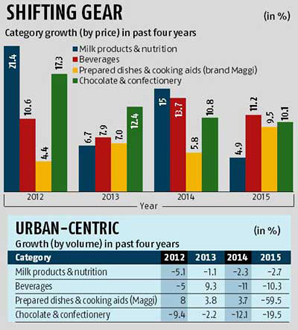

The script remained unchanged despite categories such as beverages, chocolates and confectionery, and milk products and nutrition giving Nestle nearly 80 per cent of its top line

Nestlé India's sales growth in the first six months of this year followed a familiar script: high dependence on instant noodles Maggi.

Nestlé India's sales growth in the first six months of this year followed a familiar script: high dependence on instant noodles Maggi.The script remained unchanged despite categories such as beverages, chocolates and confectionery, and milk products and nutrition giving Nestlé nearly 80 per cent of its top line.

Prepared dishes and cooking aids, which includes Maggi noodles, contribute around 20 per cent to Nestlé's topline since the ban on the noodles last year. It was 31 per cent prior before the ban.

Growth-wise though sales numbers are skewed in favour of Maggi noodles. Out of Nestlé's overall domestic volume growth of 7.3 per cent for the first half of the year, contribution of categories excluding noodles was 0.5 per cent only. Value growth of the non-noodle portfolio, on the other hand, declined 0.7 per cent for the period under review.

Analysts pin down the low contribution of Nestlé's non-noodle portfolio to overall sales growth on the company's premiumisation strategy. Traditionally, as Naveen Kulkarni, co-head, research at brokerage PhillipCapital, says, Nestlé has opted to operate at a significant price premium to rivals in most of its product categories. According to experts, this price premium has been nothing else than 15-20 per cent in most segments.

Even in a mass-market category such as noodles, Nestlé took up the price of Maggi up by 20 per cent before the ban, opting to keep it there following relaunch. This when most other players continued to be available at Rs 10 per unit.

Even in a mass-market category such as noodles, Nestlé took up the price of Maggi up by 20 per cent before the ban, opting to keep it there following relaunch. This when most other players continued to be available at Rs 10 per unit.The result, as Suresh Narayanan, chairman & managing director, Nestlé , had told Business Standard earlier is that it remains largely an urban-centric, premium player - something which analysts say is the company's DNA. Shifting to double-digit volume growth from a price-led strategy as the company indicated in a recent concall, say experts, may not be easy.

Second, the focus on price-led growth has also ensured that Nestlé's operating margins have consistently remained high in the fast moving consumer goods market, hovering in the 19-22 per cent region in the last five quarters. The only time when operating margins slipped to levels of about 15.3 per cent was in the September 2015 quarter, which corresponded with the Maggi ban, sector analysts said.

Shifting focus away from price-led growth therefore could hit margins, something the company would like to avoid given that agri-commodity prices have been shooting up, they said.

In response to a specific query on price and volume growth, Narayanan clarified during the analysts concall on Monday. "The strategy for the organisation is (volume) growth, but that does not mean that margins will suddenly go out of the window. Where we need to defend it (price), we will do it; fight head-to-head on a price-point relative strategy. But what the company is seeking to do is look at what it can bring to the table in terms of food science, technology and brand leverage.â€

Advertisement