Propelled by the power of props

By Surender Gnanaolivu | October 17, 2017

With the Indian consumer seeking for and responding positively to brands offering superior experience, the need for reimagined and updated visual merchandising has been an imperative retailing requirement for retailers & brands.

The Indian Textile and Clothing sector, one of the oldest industries in India, is estimated around US$ 108 billion and is expected to double to US$ 223 billion by 2021 (Indian Brand Equity Foundation - IBEF). The lifestyle segment is in the growth phase with categories like apparel, jewellery and fashion accessories with 10-12% of them from the online domain (Boston Consulting and RAI report Feb 17), many of them venturing into brickand-mortar.

The Indian Textile and Clothing sector, one of the oldest industries in India, is estimated around US$ 108 billion and is expected to double to US$ 223 billion by 2021 (Indian Brand Equity Foundation - IBEF). The lifestyle segment is in the growth phase with categories like apparel, jewellery and fashion accessories with 10-12% of them from the online domain (Boston Consulting and RAI report Feb 17), many of them venturing into brickand-mortar.

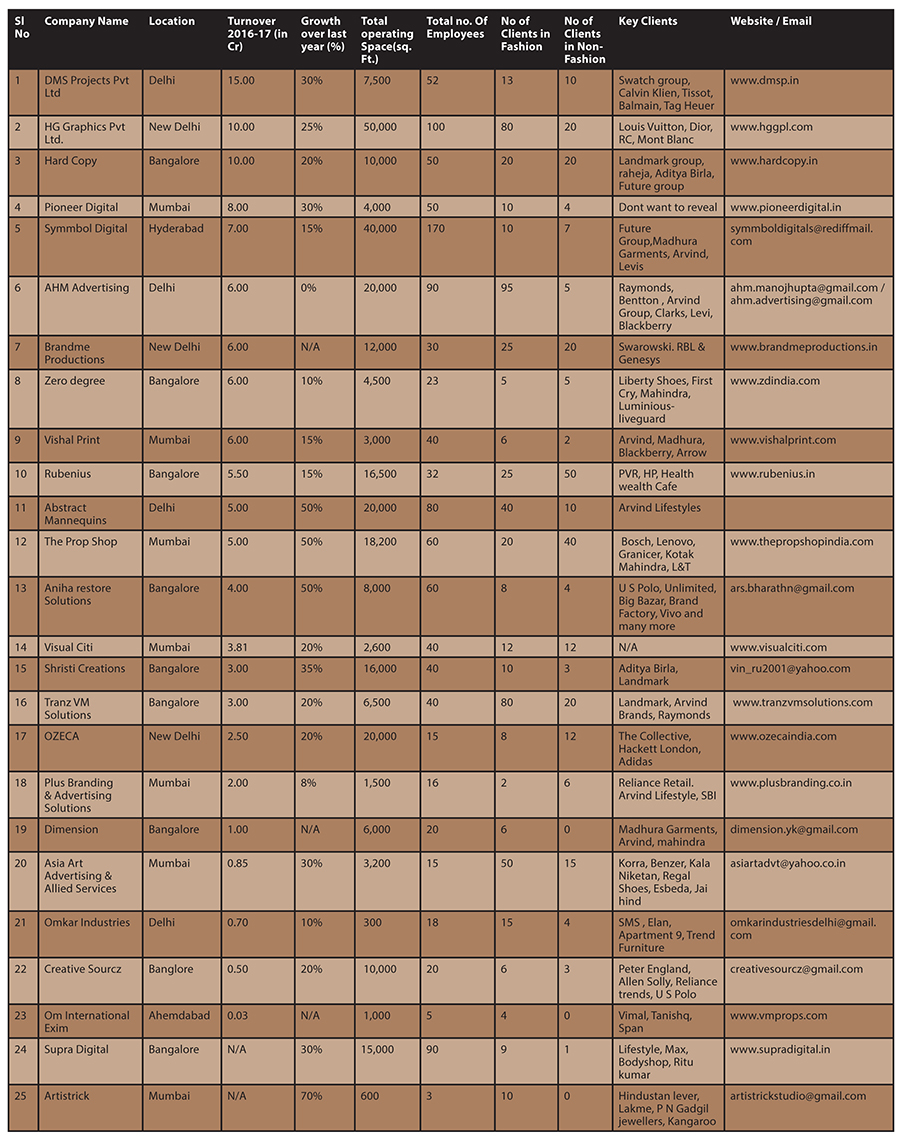

With the Indian consumer seeking for and responding positively to brands offering superior experience, the need for reimagined and updated visual merchandising has been an imperative retailing requirement for retailers & brands. The industry that has been impacted positively by this is the relatively nascent Indian VM & Props Industry. VM&RD took a close look at the current trends, by connecting with 25 of the top VM & Props suppliers in India. Our interaction with them reveals that they have been very busy in playing a vital role in servicing millions of square feet of retail space annually of existing and new additions. The top 5 trends in the VM & Props industry from the conversations are as follows:

1. With digital media and screens being introduced in visual merchandising, the use of print and signage has been controlled and the mandate has been to deploy this in VM and Props hence drastically increasing demand in this industry.

2. The top 25 vendors are spread equally across 3 metros in India namely, Delhi, Mumbai & Bangalore probably because of them being the top retail markets in India.

3. The quality of production has vastly improved in India owing to the investment in technology and skilled manpower in manufacturing.

4. The need to service a diverse group of brands and categories has enabled the development of skills and infrastructure to customize in short cycles. The need for skilled manpower is a challenge in this Industry as each project has multiple processes and materials used that need different workmanship.

5. With most of the production being done post the purchase order, the range of props readily available from a catalogue is very limited. Owing to this, China still remains a favourite destination for importing props owing to the availability of ‘off-the-shelf’ options that have been consolidated in large markets where all the vendors are present.

Some interesting quantitative highlights of the findings are:

1. This industry is quite young with over 88% of the players being under 10 years in existence. The mere 12% of the who are above 20 years old too have entered this domain only in the last decade.

2. The growth of this industry is a very healthy 28% owing to the high demand and shortage of adequate suppliers. This is encouraging new players and existing players with infrastructure to enter.

3. The total revenue generated from the top 25 players is over 100 Cr with the average of each being a low 5 Cr though the top players are over about 3 times that average.

4. Compared to the fixture industry’s higher space manning density of 450 sft per person this industry has a higher rate of 250 sft per person owing to high production customization that needs manual intervention.

5. The top 25 players are servicing over 800 clients with an average of about 34 clients each with the top 4 players servicing a challenging 100 Clients! 45% of the overall Clients for the industry are from the North region.

6. About 68% of the Clientele are from the Apparel and Industry with the rest being from the non-apparel industry.

7. About 20% of the players are exporting on an average of 14% of their annual production which indicates that some of them are ready to compete in International markets. In conclusion, it is evident that supply is still inadequate for the rising demand and hence there is lot more room for more players and growth of current ones. India’s display and visual merchandising fraternity desperately needs support to help their brands PAN India to compete in a growing market. With the growth of the VM & Props Industry, consumer experience will be heightened and bottom lines improved for clients hence giving a positive push to the whole ecosystem.