57% consider brand’s reputation while making a purchase: Axis My India CSI Survey

By Retail4Growth Bureau | July 05, 2022

The survey also shows that 31% further consider the price-point as vital factor and 8% are dependent on the availability of the product. Further, 4% said that they consider advertising and marketing as important influencers for their decision.

Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues.

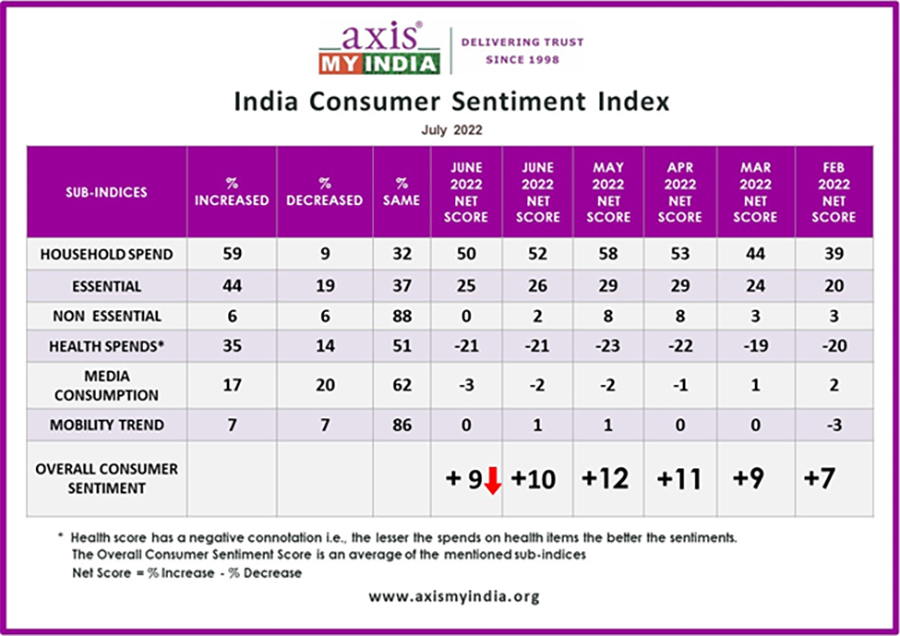

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits & mobility trends.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said, “Overtime, consumer spending has reached a status quo bias where the keenness to increase consumption has been limited. This is mainly due to inflation and the after effects of pandemic which has made it difficult for consumers to see their nominal incomes recover to pre-pandemic levels. Digital viewership is on a high trajectory. In terms of consumption behaviour, a significant proportion of consumers are increasingly taking their purchase decision basis reputation of the brand with price as the 2nd key factor, which shows the growing maturity of Indian consumers.”

Key findings:

- Overall household spending has increased for 59% of families which reflects a 2% dip from the last month. The net score which was at +52 last month has decreased by -2 to +50 this month.

- Spends on essentials like personal care & household items remain the same for 37% of the families which is an increase by 4% from last month. Spending however has increased for 44% of the families, which reflects a dip by 2% (i.e. 46%) from last month. The net score which was +26 last month has reduced by -1 to +25 this month.

- Spends on non-essential & discretionary products like AC, Car, and Refrigerator remains the same for 88% of families, reflecting an increase of 2% from last month. Spends however has increased for only 6% of families reflecting a slight dip of 2% from last month. The net score which was at +2 the previous month has dipped to 0 this month.

- Consumption of health-related items more or less remains the same for 51% of the families, an increase by 2% from last month. Consumption has increased for 35% of the families, reflecting a dip by 1% from last month. The health score which has a negative connotation i.e., the lesser the spends on health items the better the sentiments, has a net score value of -21, same as last month.

- The survey dug deeper to understand factors that determine respondent’s purchase considerations. A majority of 57% consider the reputation of the brand as an important factor while purchasing from it while 31% further consider the price-point as vital factor. 8% said they are dependent on the availability of the product while 4% said that they consider advertising and marketing as important influencers for their decision.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 10409 people across 35 states & UT’s. 70% belonged to rural India, while 30% belonged to urban counterparts. In terms of regional spread, 24% of each belonged to Northern and Eastern parts while 29% and 23% belonged to Western and Southern parts of India respectively. In addition, 63% of the respondents were male, while 37% were female. In terms of the two majority sample groups, 28% reflect the age group of 36YO to 50YO, while21% reflect the age group of 26YO to 35YO.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said, “Overtime, consumer spending has reached a status quo bias where the keenness to increase consumption has been limited. This is mainly due to inflation and the after effects of pandemic which has made it difficult for consumers to see their nominal incomes recover to pre-pandemic levels. While in response to this the government has reduced the petrol and diesel prices, a major chunk of consumers are still looking for further ease. Similarly in media, one can witness respondents suffering from consumption fatigue which could be related to innumerable choice of content, ease in mobility and the availability of experiencing ‘cinema’ etc. The craze around IPL persists across platforms but whether this excitement justifies its high media rights, time will tell. Digital viewership is on a high trajectory. In terms of consumption behaviour, a significant proportion of consumers are increasingly taking their purchase decision basis reputation of the brand with price as the 2nd key factor, which shows the growing maturity of Indian consumers.”

Comments