Personal luxury goods market experiencing slowdown, but India is must-watch market, says BCG report

By Retail4Growth Bureau | July 24, 2025

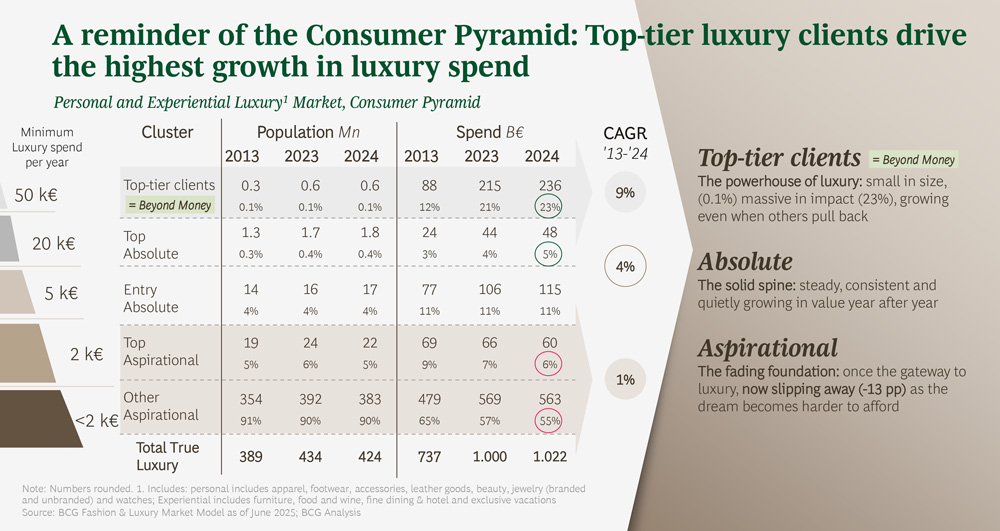

Aspirational consumers are pulling back, while top-tier clients are confirmed to become the key engine for long-term value, says the report from the Boston Consulting Group.

Luxury is at a turning point. For the first time in more than a decade, the Personal Luxury Goods Market is experiencing a slowdown in growth, with flat to slightly negative performance expected in 2025, says Boston Consulting Group ‘s ‘True Luxury Global Consumer Insights 2025’. The report reveals a fundamental market shift: aspirational consumers—the entry point for many into luxury—are pulling back, while top-tier clients are confirmed to become the key engine for long-term value.

The report, based on a global survey of luxury consumers across all spending tiers, with a focus on the ultra-spenders, provides a clear path forward for brands seeking to grow in a challenging environment.

“The global luxury market is at an inflection point—while aspirational consumers pull back, top-tier clients, who make up just 0.1% of the population, are driving 23% of all luxury spend. India is not yet the ‘next China’, but with its HNW and UHNW population growing at 11–15% CAGR through 2034, it is fast becoming a must-watch market for global luxury brands,” says the report.

“As wealth creation accelerates and a young, brand-conscious demographic rises, brands are setting the stage for deeper local engagement. The future of luxury lies in re-focusing on craftsmanship, personalization, and intimate experiences—especially in emerging markets like India where aspiration is increasingly backed by affluence,” adds the report.

Key findings of the report:

· Aspirational buyers are really slipping away: Once accounting for 70% of the luxury market, aspirational consumers have lost almost 15 percentage points in share as affordability concerns rise.

· The cost of chasing scale, losing soul in luxury: Luxury was once the realm of the few, but in the race for scale, much of the industry lost its soul and traded exclusivity for reach, stability for volatility. Brands overly exposed to Aspirational consumers are seeing their performance erode.

· The way forward starts at the core: The most resilient brands are those focused on top-tier clients - clients that spend on average 355.000 euro per year on luxury and build on an underlying HNWI audience of over 900,000 individuals growing ~10% annually. The report calls for a back to the core strategy: both on the core luxury consumer and on the core luxury fundamentals, by meeting top-client’s expectations.

· Find them where they spend. Personal Luxury remains their baseline, but the share of wallet of those individuals spans beyond it: luxury is no longer confined to ownership—it is now about lifestyle orchestration, with a shift towards ‘health-as-wealth’ mindset

· What they expect from brands, they do not get. What they want is simple: connection, intimacy, excellence, recognition. What do they get? A luxury that still feels too noisy, too crowded, too industrialized. Brands need to refocus their strategy, centered on high-touch, human-led client relationships (enhanced by GenAI), exclusive experiences, and vertically integrated product quality.

“Building a stronger luxury industry means returning to what made it exceptional in the first place, especially for top-tier clients: deep connection, quality, and trust with the most valued clients,” the report summarizes.

Comments