Emami eyes further acquisition to grow health and personal care segments

Vjmedia Works | August 03, 2017

In the past, the firm also acquired Zandu brand which opened up its presence in the balms business.

Emami Ltd, a company that has grown its portfolio and market share through acquisitions in segments it did not have a presence in earlier, is now eyeing new deals this year to grow its healthcare and personal care products.

"We are open to acquiring both small-sized as well as big companies, provided the brand value and the business model is good. We can acquire companies that have a Rs 50-500 crore turnover," Harsh V Agarwal, director at Emami Ltd, said after the company's annual general meeting here.

Asked if the Goods and Services Tax (GST) had opened up more possibilities for the company to make acquisition of smaller companies which have been able to build a brand over the years, he said, "We are open to acquisitions in both these spaces."

Analysts feel that as a result of GST, which calls for tighter compliance norms, several companies in the consumer goods space will be up for grabs by larger FMCG (fast moving consumer goods) firms which might try to take over the smaller players.

In June 2015, the mid-tier FMCG firm, Emami Ltd acquired Kesh King for Rs 1,651 crore in one of the largest deals in the FMCG space then. This opened up an entirely new market for Emami as its growth in the hair care segment primarily depended on this acquisition.

In the past, the company also acquired the Zandu brand which opened up its presence in the balms business.

"This year, our core focus will be on healthcare and personal care products. There will be brand extensions as well as new launches", Agarwal said.

The company is also keen to increase its presence in Bangladesh by widening the product range as it expects that country's growth to be considerably higher than other foreign markets it operates in.

Moreover, Bangladesh accounts for 30 per cent of Emami's consolidated international sales.

Q1 net dives 98 per cent to Rs 1.04 cr

Q1 net dives 98 per cent to Rs 1.04 cr

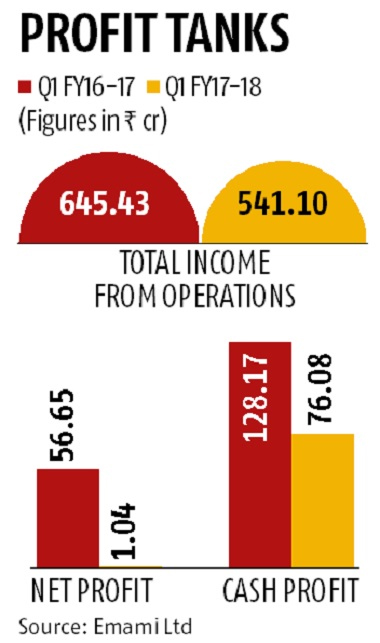

Emami Ltd posted a dismal financial performance for the quarter ended June 31, 2017, with its net profit falling by over 98 per cent to Rs 1.04 crore, while the topline plunged over 16 per cent to Rs 541 crore.

The net profit and net sales during the first quarter of the last financial year stood at Rs 57 crore and Rs 645 crore respectively.

Harsh V Agarwal, director, Emami Ltd, blamed the resultant destocking by its sales channel in the wake of demonetisation as the primary reason behind the financial performance. Over 50 per cent of the company's sales are routed through wholesale channels which took the maximum hit.

The company's chairman, R S Agarwal, during his address to shareholders said that the company has initiated the process of reducing its dependence on wholesale channels and increasing emphasis on direct distribution.

"In FY 16-17, the company has increased its direct distribution by 1,00,000 to 7,30,000 outlets with a vision to ramp it up up to 8,00,000 in the current year", he said.

Harsh Agarwal said the dampened sales in its international operations was another reason behind the weak performance in the last quarter.

"An inventory correction in the international business has been done and the coming financial year quarters will be good for the company", he added.

In the domestic market, Emami's sales were hit by 16-17 per cent and revenue from international operations was down 17-18 per cent.