Fast-food chains chase growth in slowdown

By Dinesh Jain | Vjmedia Works | February 14, 2014

Most chains saw a fall in same-store sales in the December-ended quarter, but that hasn't affected their expansion plans

Jubilant Foodworks, the Shyam and Hari Bhartia company which runs Domino's and Dunkin Donuts quick-service restaurants in India, is putting final touches to its first two Dunkin Donuts outlets in Mumbai. The stores - at R City Mall in Ghatkopar and Phoenix Market City in Kurla - are expected to be launched in a few months. More will follow in quick succession across the city. All told, it wants to add 20 new Dunkin Donut outlets in the country, which will take the tally to 30 by the end of the current financial year. This is not all. Instead of 135 new Domino's stores that it proposed to add in 2013-14 across India, it now says it will add 145, of which 103 have opened so far. There is nothing in the flurry of activity to suggest that business of late has been bad: its same-store (those at least a year old) sales fell 2.6 per cent in the December-ended quarter - its worst quarter so far.

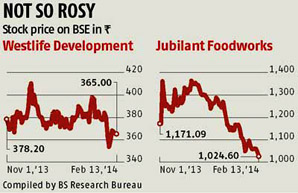

Jubilant Foodworks, the Shyam and Hari Bhartia company which runs Domino's and Dunkin Donuts quick-service restaurants in India, is putting final touches to its first two Dunkin Donuts outlets in Mumbai. The stores - at R City Mall in Ghatkopar and Phoenix Market City in Kurla - are expected to be launched in a few months. More will follow in quick succession across the city. All told, it wants to add 20 new Dunkin Donut outlets in the country, which will take the tally to 30 by the end of the current financial year. This is not all. Instead of 135 new Domino's stores that it proposed to add in 2013-14 across India, it now says it will add 145, of which 103 have opened so far. There is nothing in the flurry of activity to suggest that business of late has been bad: its same-store (those at least a year old) sales fell 2.6 per cent in the December-ended quarter - its worst quarter so far.Jubilant Foodworks, headquartered in Noida, is not the odd one out in the business of quick-service restaurants: almost every other company is looking to add stores despite a visible slump in sales. Yum, the owner of brands such as Pizza Hut, Taco Bell and KFC, saw same-store sales fall 4 per cent in the December-ended quarter but wants to add 400 stores in Tier II and III cities in the next two years. The company has already crossed 600 stores in India and has no plans to slow down. The same goes for Westlife Development, whose subsidiary Hardcastle Restaurants is the franchisee of McDonald's in the west and south of India. The BL Jatia-promoted company proposes to add 75 to 100 stores in the next two years, despite same-store sales slumping 9.8 per cent in the December-ended quarter and 5.5 per cent in the quarter before that.

The decrease in sales is being attributed to the contraction in the discretionary expenditure of households. The prolonged slowdown in the service and industry sectors has impacted urban incomes. High food inflation, which has now started showing signs of easing, has made them curtail non-essential expenditure. This has started to show in the performance of the quick-service restaurants. Worse, there is no sign when the situation might improve. Still, the companies in the sector are bullish. Ajay Kaul, the chief executive officer of Jubilant Foodworks, says, "India can accommodate 1,200 Domino's stores. Our current count is 679 stores. If you look at the gap, there is still some way to go before we can reach our full potential here." Like most others, Kaul believes the business sentiment will improve after the general elections in May this year. "While the environment is uncertain at this stage, the tide will turn after the elections. Things will begin to look up," he says.

the Shyam and Hari Bhartia company which runs Domino's and Dunkin Donuts quick-service restaurants in India, is putting final touches to its first two Dunkin Donuts outlets in Mumbai. The stores - at R City Mall in Ghatkopar and Phoenix Market City in Kurla - are expected to be launched in a few months. More will follow in quick succession across the city. All told, it wants to add 20 new Dunkin Donut outlets in the country, which will take the tally to 30 by the end of the current financial year. This is not all. Instead of 135 new Domino's stores that it proposed to add in 2013-14 across India, it now says it will add 145, of which 103 have opened so far. There is nothing in the flurry of activity to suggest that business of late has been bad: its same-store (those at least a year old) sales fell 2.6 per cent in the December-ended quarter - its worst quarter so far.

Jubilant Foodworks, headquartered in Noida, is not the odd one out in the business of quick-service restaurants: almost every other company is looking to add stores despite a visible slump in sales. Yum, the owner of brands such as Pizza Hut, Taco Bell and KFC, saw same-store sales fall 4 per cent in the December-ended quarter but wants to add 400 stores in Tier II and III cities in the next two years. The company has already crossed 600 stores in India and has no plans to slow down. The same goes for Westlife Development, whose subsidiary Hardcastle Restaurants is the franchisee of McDonald's in the west and south of India. The BL Jatia-promoted company proposes to add 75 to 100 stores in the next two years, despite same-store sales slumping 9.8 per cent in the December-ended quarter and 5.5 per cent in the quarter before that.

The decrease in sales is being attributed to the contraction in the discretionary expenditure of households. The prolonged slowdown in the service and industry sectors has impacted urban incomes. High food inflation, which has now started showing signs of easing, has made them curtail non-essential expenditure. This has started to show in the performance of the quick-service restaurants. Worse, there is no sign when the situation might improve. Still, the companies in the sector are bullish. Ajay Kaul, the chief executive officer of Jubilant Foodworks, says, "India can accommodate 1,200 Domino's stores. Our current count is 679 stores. If you look at the gap, there is still some way to go before we can reach our full potential here." Like most others, Kaul believes the business sentiment will improve after the general elections in May this year. "While the environment is uncertain at this stage, the tide will turn after the elections. Things will begin to look up," he says.

No slowdown blues here

Still others believe that the slowdown is a good time to invest because real estate (the most important factor in the success of a store) has become cheap. This, coupled with the under-penetration of the market, explains the current expansion drive of the quick-service chains. What gives these players the confidence to expand their footprint is the under-penetration of the food-services market in India. A report by brokerage CLSA says that the sales generated in chained format is below 10 per cent of the total in India as compared to 25 per cent in markets such as Thailand, Indonesia and the Philippines. This creates a huge upside for growth.

The growing trend of nuclear families, working women and rising disposable incomes is expected to fuel growth of the market. This, say experts, is already visible. The consumption of food as a share of wallet among urban households is down to about 27 per cent from 35 per cent five years ago, according to estimates from experts attached to the food services industry. This is because consumers, explains Anand Ramanathan, associate director, KPMG Advisory, are eating out more than they did earlier. "If you look at consumer behaviour, the propensity to eat out is greater than it was earlier," says he. "India has a vast population under 30, and this segment has a greater tendency to eat out."

This explains why despite the dip in sales numbers in the last few quarters, food retailers are in no mood to give up just yet. Amit Jatia, the vice-chairman of Westlife Development, says, "The long-term potential of the market remains intact, which is why most players continue to make serious investments behind store expansion." According to him, the expansion opportunities are unlimited. "We have the ability to drive an aggressive, yet disciplined growth plan by continuing to methodically expand our restaurant footprint," says he. "In the December quarter alone we added 10 restaurants in markets such as Maharashtra, Gujarat, Karnataka and Andhra Pradesh. "Financiers agree with this assessment of the situation. Westlife last year raised Rs 180 crore from Singapore-based Arisaig Partners in a bid to fund its proposed Rs 300-crore expansion in the next two years. Jubilant Foodworks has lined up capital expenditure of Rs 250 crore to open new stores, improve the existing stores and beef up the backend.

What makes the current round of expansion different from the earlier ones is that most quick-service chains are now adding stores in smaller towns and cities. This is what will drive their growth in the days to come. Kaul of Jubilant Foodworks says that top ten cities in the next few years will account for 50 per cent of all Domino's stores in the country, down from 60-65 per cent now. "If you look beyond the top ten cities, there is certainly good potential for growth," he says. Jatia reiterates this point without getting into the break-up of his stores located in big and small cities. But Westlife is believed to be aggressively getting into smaller towns in states such as Maharashtra, Gujarat, Karnataka and Andhra Pradesh. This week it opened its 18th store in Gujarat in the city of Rajkot.

Yum is also expected to add its new stores in smaller towns and cities since that is where it sees the next phase of growth for itself given that the top ten cities are increasingly becoming crowded with no dearth of choice for consumers. Ramanathan of KPMG says, "Retail developments are happening everywhere: in metros, mini-metros, small towns and cities. That is one reason why quick-service chains are finding it convenient to tap into the smaller markets. Plus the consumers there are aspirational, wanting to eat out, which is further fuelling the trend." In the long run, we will all eat out.

Advertisement