Crompton Greaves consumer arm to be demerged, listed

Vjmedia Works | July 18, 2014

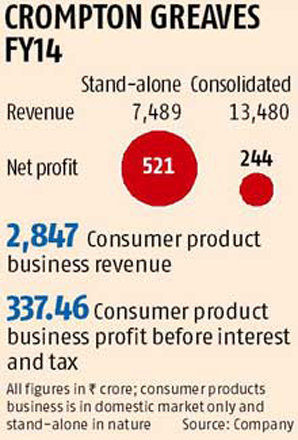

The division accounts for 21% of consolidated revenue and half of profit

Crompton Greaves has decided to demerge and list its profitable consumer product business, sparking speculation of a stake sale by its promoter, the Avantha Group.

Crompton Greaves has decided to demerge and list its profitable consumer product business, sparking speculation of a stake sale by its promoter, the Avantha Group.On Wednesday, the company's board proposed a demerger of the business for "better growth opportunitiesâ€. The consumer business division contributed about 21 per cent of the company's revenue and around half the profit before interest and tax in 2013-14.

About 45 per cent of Crompton Greaves' consolidated revenue comes from overseas operations, but the consumer products division that manufactures fans and lighting appliances sells only in India. The company's other businesses comprise power and industrial systems. On Thursday, the Crompton Greaves stock closed 13.45 per cent higher at Rs 210.85 on the BSE.

Equity analysts are valuing the company's consumer products business at Rs 5,500-6,500 crore based on their 2015-16 earning estimate and believe the demerger could lead to a stake sale by the Avantha Group. Promoters hold 42.67 per cent in Crompton Greaves, which has a market capitalisation of Rs 13,500 crore.

Crompton Greaves had previously termed talk of a stake sale as speculation. On Thursday, the company issued no comment on the issue.

Crompton Greaves had previously termed talk of a stake sale as speculation. On Thursday, the company issued no comment on the issue.In its notification to stock exchanges, Crompton Greaves said the demerger would create growth opportunities for its two large but significantly different businesses.

"The board also believes this will create a more flexible capital structure for the two businesses to grow independently, allow them to pursue more ambitious strategic goals and, thus, create further value for existing shareholders. The board has constituted a committee of directors to examine all relevant aspects of the process of demerger and listing and make suitable recommendations to the board,†the company said. In a note to investors, Kotak Securities said the demerger would lead to improved performance and take away the overhang of volatility of the power system business. The consumer product segment's share in profit before tax and interest has risen from 20-25 per cent three-four years ago to about 50 per cent now as company's foreign business has been making a loss.

Kotak Securities said the consumer products business had a high return on capital employed of about 300 per cent and could trade at a premium. "A clearer corporate structure would also open the way for Crompton Greaves to attract strategic investors in the two businesses,†it said.

"The demerger would result in the consumer business being accorded a higher multiple than the parent company. Peers in the consumer electrical business trade at a higher multiple as compared to Crompton Greaves,†said IIFL Capital in a note to its clients.

In 2013-14, the consumer product division earned Rs 2,847 crore in revenue (21 per cent of consolidated revenue) with a 11.9 per cent margin. The segment contributed Rs 337 crore to profit before interest and tax.

Advertisement