Dawn of the hyper-locals

By Dinesh Jain | August 03, 2015

A recent IMRB study drives home the growing influence of local brands and how they are threatening national brands in a big way, notably, in food

Do names such as Sudha, Arokya, Sakthi, Thirumala, Aavin or Nandini strike a bell at all? They don't, right? But these products figure prominently in the recently released IMRB-Kantar Brand Footprint report. Unlike conventional brand valuation studies, this report looks at where a brand stands based on how many times a consumer chooses it over another. And the percentage of homes out of the total household universe that bought the brand at least once a year. IMRB calls this consumer reach point (CRP).

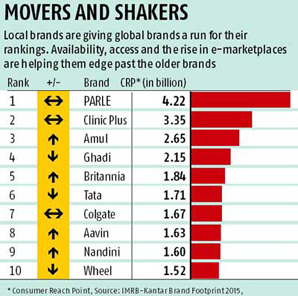

Do names such as Sudha, Arokya, Sakthi, Thirumala, Aavin or Nandini strike a bell at all? They don't, right? But these products figure prominently in the recently released IMRB-Kantar Brand Footprint report. Unlike conventional brand valuation studies, this report looks at where a brand stands based on how many times a consumer chooses it over another. And the percentage of homes out of the total household universe that bought the brand at least once a year. IMRB calls this consumer reach point (CRP).In the 2015 list of top 50, there are 10 local brands that make the cut - two more than the number last year. The highest-ranked among the local brands - Aavin, a milk brand, which comes at number eight - has a CRP of 1.63 billion - just below Colgate (number 7), which has a CRP of 1.67 billion. To acquire the eighth spot, Aavin has edged out incumbent Wheel - Hindustan Unilever's mass-market detergent brand - which has been pushed to 10th position this year. This is not all. At ninth position comes another local milk brand called Nandini, which has moved up from 10th place last year.

The fact that 20 per cent of this year's list is dominated by local brands - four percentage points more than last year indicates how these products are gaining traction, say market experts. "Most of these (local) brands are in milk and biscuits, categories that are consumed by households on a regular basis," says Varun Sinha, group business director, IMRB Kantar Worldpanel. But so are categories such as shampoos, detergents, soaps, creams, hair oils, tea and toothpastes that have also marked their presence on the list. In the case of these segments, it is the national and top regional names that are more visible. They include brands such as Clinic Plus (shampoo), Head & Shoulders (shampoo), Ghadi (detergent), Chik (shampoo), Lifebuoy (soap), Colgate (toothpaste), Nirma (detergent), Fair & Lovely (cream), Brooke Bond (tea), Lux (soap) and Parachute (hair oil), among others. Even segments such as mosquito repellents and coffee, not very highly penetrated in India, find a place on the list, but through big names such as Good Knight and Bru, respectively.

While some of the top names in milk and biscuits do figure on the list too - such as Parle (biscuits) at number one, Amul (milk) at number three and Britannia (biscuits) at number five, there is no way one can miss the local brands (from the two categories). Five of the top 20 in the current report are local food brands. They include Milma (milk), Anmol (biscuits) and Vijaya (milk) apart from Aavin and Nandini. National food brands in the top 20 are just a notch higher at six. They include names such as Maggi, Mother Dairy and Brooke Bond besides Parle, Amul and Britannia. And four of the five brands that have seen the sharpest rise in CRP in 2015 are regional milk and biscuit brands.

Experts pin the trend down to the local nature of food and its easy proliferation and acceptance. "While local brands are not uncommon in other consumer staples such as soaps, detergents or hair oils, brand building (at the national level) is a little easier in these categories as opposed to food," says Harish Bijoor, CEO, Harish Bijoor Consults.

Experts pin the trend down to the local nature of food and its easy proliferation and acceptance. "While local brands are not uncommon in other consumer staples such as soaps, detergents or hair oils, brand building (at the national level) is a little easier in these categories as opposed to food," says Harish Bijoor, CEO, Harish Bijoor Consults.Ease of availability is also a key reason for the rampant growth of local brands in milk and biscuits - something that national brands such as Amul and Mother Dairy (the latter has retained its fourteenth spot in the current report) - have been looking to counter by improving their reach. Amul, for instance, is available across Gujarat, Maharashtra, Goa, Madhya Pradesh, Uttar Pradesh, National Capital Region (NCR) and New Delhi. Rival Mother Dairy has been making inroads in the west beyond its comfort zone of Delhi/NCR.

The local brands also owe a huge debt to the mobile penetration in the country and the rise of mobile payment mechanisms. In fact the report talks about how fast-moving consumer goods 3.0 is going to be a lot about the growth of mobile - it says, phone based money transfer services are set to change the way people buy, thereby offering brands a whole new way to go where no brand has gone before. More power to the local brands.

Advertisement