Hush Hush, No More!

By Satarupa Chakraborty | August 28, 2018

Democratised as a category in mainline retail, Lingerie is a category which has finally arrived with a bang. The projected growth of $9 billion in next 4 years also announces a rise in number of stores, suave retail design and more brands joining the bandwagon. VM&RD brings the category out of closet.

While the overall apparel market is growing at 8%, the lingerie market is growing at a staggering 22% (Source Technopak reports), almost 2.5 times faster. Clearly, intimate wear is evolved, mature and democratised. Last few years, India’s retail market has welcomed a league of globally-celebrated lingerie brands like Hunkemoller, Women’Secret and more while the sensational names like Victoria’s Secret and Pink will soon be strengthening the international repertoire. In the same time period, there has been a steady influx of domestic brands surfacing in this category, most of which started as online players and came to offline expansion within a few years of inception. In fact, omni-channel looks like a clear roadmap of success for most of the homegrown lingerie

While the overall apparel market is growing at 8%, the lingerie market is growing at a staggering 22% (Source Technopak reports), almost 2.5 times faster. Clearly, intimate wear is evolved, mature and democratised. Last few years, India’s retail market has welcomed a league of globally-celebrated lingerie brands like Hunkemoller, Women’Secret and more while the sensational names like Victoria’s Secret and Pink will soon be strengthening the international repertoire. In the same time period, there has been a steady influx of domestic brands surfacing in this category, most of which started as online players and came to offline expansion within a few years of inception. In fact, omni-channel looks like a clear roadmap of success for most of the homegrown lingerie  brands who made it big.

brands who made it big.

Democratisation Of Lingerie Retail

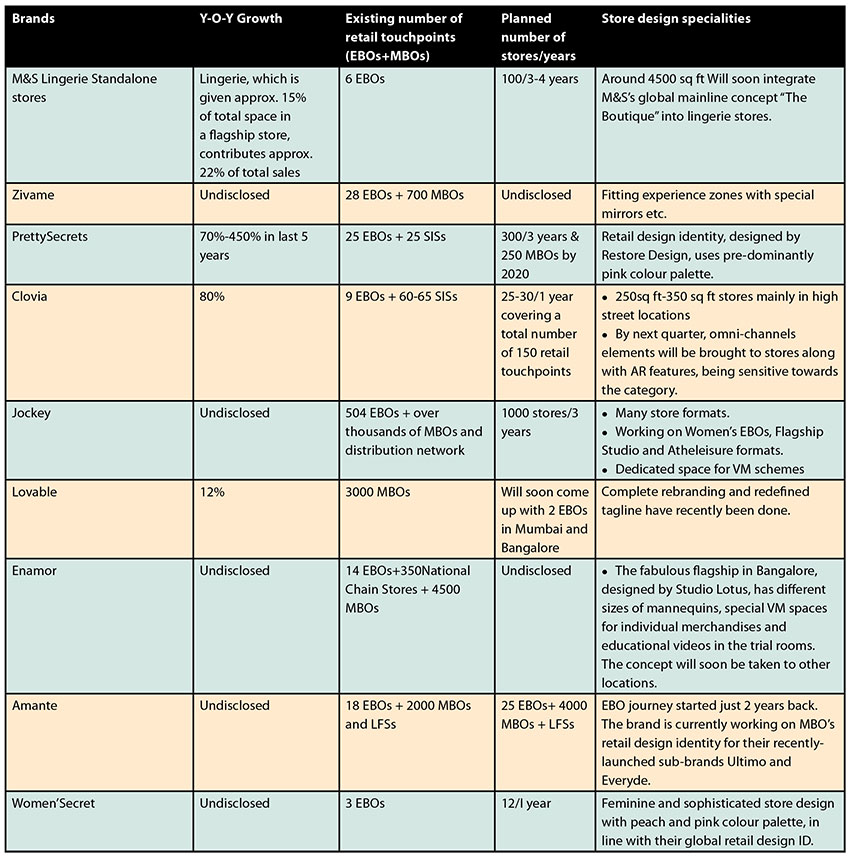

When leading British retailer Marks & Spencer opened their 15000 sq ft flagship at Phoneix Marketcity Mall, Bangalore, the store was expected to have a lingerie section. The retailer still decided to add a standalone lingerie store just next door. Back in their country of origin, the UK, one out of three women use M&S lingerie, however, the British retailer came up with this special store format only in India. Today, M&S has 6 lingerie standalone stores and they plan to add 100 such formats in next 3-4 years.

Does that mean, Indian mall spaces are dedicated well towards lingerie retail? Karan Bahl, Founder & CEO, PrettySecrets, an omnichannel lingerie brand, which is growing at 150%, throws a surprise, “Globally, 4-8% sales of any mall is coming from lingerie category, whereas in India, it’s still stuck at about 1%. Within the category, India still has a bandwidth of either utilitarian or fancy merchandises. It was our conscious decision to come somewhere in between.” Starting their offline expansion only a year back, PrettySecrets has 25 stores in their network and plans to be present through 300 exclusive outlets within next 3 years.

Does that mean, Indian mall spaces are dedicated well towards lingerie retail? Karan Bahl, Founder & CEO, PrettySecrets, an omnichannel lingerie brand, which is growing at 150%, throws a surprise, “Globally, 4-8% sales of any mall is coming from lingerie category, whereas in India, it’s still stuck at about 1%. Within the category, India still has a bandwidth of either utilitarian or fancy merchandises. It was our conscious decision to come somewhere in between.” Starting their offline expansion only a year back, PrettySecrets has 25 stores in their network and plans to be present through 300 exclusive outlets within next 3 years.

Dominance Of Domestic Brands

Just as other categories, Indian retail is attracting foreign brands even in lingerie category. However, homegrown brands are still leading in terms of store network and business.

Just as other categories, Indian retail is attracting foreign brands even in lingerie category. However, homegrown brands are still leading in terms of store network and business.

Spanish Brand Women’Secret entered India last year with south India’s leading retail company Tablez Group and has 3 stores so far in Bangalore and Mumbai. Slated to close 2019 with a total number of 12 retail doors, Adeeb Ahamed, MD, Tablez Group, shares their location strategy for expanding store network, “For 2019, we would be predominantly present in metro cities Delhi and Mumbai. We are also looking at the east for expansion along with strengthening our base in the south of India through Metros.” Similarly, brands like  Hunkemoller (brought to India by Reliance Brand Limited) and La Senza (brought to India by Major Brands), operating in India for quite a few years, have only consolidated their store presence maximum at all metros.

Hunkemoller (brought to India by Reliance Brand Limited) and La Senza (brought to India by Major Brands), operating in India for quite a few years, have only consolidated their store presence maximum at all metros.

Surprisingly, though single brand international titles are available in India, multi brands are not. Hashtag Plus, an NCRbased start-up by D’Art Retail Pvt Ltd, is working on an even advanced concept of plus size lingerie. The company is bringing some of the leading international brands from the US, Canada and Southeast Asia and will soon start rolling out stores across India, Middle East and Africa through franchisee rollout.

Back home, online brands like Zivame, Clovia and PrettySecrets are fast taking the omnichannel route, clocking several funds and building a robust brick-and-mortar network. The trio reported a combined revenue of INR 100 crore two fiscals back. Today, they have more than doubled the number. Interestingly, many of these brands are young (not more than 5 years old) and have an online origin. Shipping a merchandise every 6 seconds, Clovia is now focusing on building a strategic brick-and-mortar network. Pankaj Vermani, Founder & CEO, Clovia, shares a trivia, “Do you know that top 10 Indian lingerie brands, which includes us as well, contribute less than 7% in overall business? The truth is that the bigger business still lies with the unorganised, semi-organised and regionallypopular brands. However, the good news is that many of these customers are turning to organised brands like us, given our competitive price points, elevated styles and customer experience.” This infers that when it comes to dominance of domestic brands in lingerie retail, organised brands, which are showing very promising revenue growth, are just tip of this grand success story.

Small Towns, Big Wonders

Having predicted the unprecedented growth of that huge of brands which are leading region-wise, does this mean that these small towns do not make big markets for organised retail brands? Leading omnichannel brand, PrettySecrets, who has consolidated its presence well in nationwide mom-and-pops lingerie stores, opened their first EBO about a year back at Manipur’s Itanagar, a town not even known to many. Today, Itanagar, with a population of only 1 lakh people, has two PrettySecrets stores and the first store still remains one of the most successful one for the brand.

Similarly, for Clovia, a brand which claims to convert its online learning to offline rollout, enjoys 55% business from online channel, within which non-metro contribution is enormous. The brand, as part of its plan to open 20-25 EBOs in next 12 months, is anchoring on small towns like Purulia and non-metro locations in Gujarat, North and South India. Interestingly, Clovia’s retail rollout only chooses high footfall non-mall locations.

For a veteran and much larger brand Jockey, the mandate seems to have worked for many years now and the brand has successful multiple stores in same vicinities. Recently crossing a number of 500 EBOs across nation, Jockey plans to open 1000 more in next 3 years. MC Cariappa, President – Sales & Marketing, Jockey India, shares, “We have innovated in our store formats to ensure that we reach tier-II, III and even rural markets. Since we operate through a large franchisee network, we are extremely vigilant towards bringing frugal benefits to our partners and reducing turnaround time.”

What Shows, Sells

Once a discreet affair and now a part of enjoyable shopping haul – how are the brands ensuring a good in-store experience? Fitting experience, comfort and education – the leading lingerie brands echoed in unison. Take the example of Enamor’s Fabulous Flagship format at Phoenix Marketcity Bangalore, designed by Delhi-based agency Studio Lotus. The store, spread across 800 sq ft, brings different size of mannequins, educational videos for trial rooms and individual VM stories for merchandises. Enamor will soon take the concept to other locations as well.

Zivame, one of the top-line brands, which actually empowered confident lingerie shopping, embarked on their offline journey with the most comprehensive store design. Swadhin Mishra, Head – Offline, Zivame, shared, “The stores have been designed around the core philosophy of providing consumers with the perfect fit. We initiated the fitting process in 2011 and created an uninhibited environment for women to shop for lingerie. We continue to fit our consumers in order to provide them with the perfect lingerie. We are constantly upgrading our stores to reflect all the latest categories and collections.”

The lingerie stores, by the virtue of smaller sizes of merchandises, are generally kept within 500 sq ft. Clovia’s phase-III planning, which is planned to be executed by next quarter, has serious plans to bring omni-channel elements to its stores. “Pure play tab environment can’t cut the chase of omni-channel. Also, lingerie is a sensitive zone. Therefore, our omni-channel in-store elements will address lot of socio-techno issues,” Vermani added.

Lovable, present in approximately 3000 retail touchpoints including some of the major LFS formats, has recently revamped their whole branding and retail design identity and is poised to start their EBO rollout soon with one store each in Mumbai and Bangalore.

The “Intimate” Inundation

Interestingly, the booming brick-andmortar expression of lingerie retail came much later than the apparel boom and today, it’s growing 2.5 times higher than the regular apparel market. As much as mall shop windows no longer shy away from bra-clad mannequins, high street and small town locations are embracing the change. The road between discreet perfunctory shopping and leisure retail experience was rather cut short by aggressive marketing campaigns and wide choices offered by some of the smart lingerie brands. Yet organised lingerie brands account for only a marginal percentage of the exponential opportunity that this category offers. As Les Wexner, CEO, L Brands and the billionaire man behind Victoria’s Secret, said, “There is always hopefully a next”, we believe there will be more and more brands in future to catapult the projected growth.