Indian market under pressure, says Unilever

By Dinesh Jain | October 14, 2016

Apart from small regional players Unilever has had to contend with the growing clout of home-grown consumer goods companies, among them Patanjali

Unilever, the world’s second-largest consumer goods company, lowered its outlook for India after reporting weak third-quarter results on Thursday, saying tepid demand and competitive intensity posed challenges to it there.

Unilever, the world’s second-largest consumer goods company, lowered its outlook for India after reporting weak third-quarter results on Thursday, saying tepid demand and competitive intensity posed challenges to it there.

Unilever’s Chief Financial Officer Graeme Pitkethly and Investor Relations Head Andrew Stephen said during analysts’ call price hikes in skin cleansing on rising commodity costs had dampened consumer demand India.

“Our market conditions have softened in India,” Stephen said. “Volume (growth) in skin cleansing (in India) has suffered from price increases. Indian markets remain subdued and under pressure,” he added.

The statement comes at a time when Unilever reported its weakest underlying volume growth at 0.6 per cent in the Asia, Africa, Middle East, Turkey, Russia, Ukraine, Belarus region in the third quarter. Unilever follows a January to December accounting year.

While this is better than the two per cent decline it saw in volume growth in the Americas and flattish growth in Europe for the third quarter, it still does not bode well for the company. Unilever derives nearly 58 per cent of its revenue from emerging markets. India provides the Anglo-Dutch major seven to eight per cent of its revenue. “There is a realisation now that returning to the double-digit growth of a few years ago may not be possible,” said G Chokkalingam, founder, Equinomics Research & Advisory. “India has and remains a key market for Unilever. But the dynamics here have changed for good. Hence, the indication of weak consumer demand and competitive intensity,” he added.

“There is a realisation now that returning to the double-digit growth of a few years ago may not be possible,” said G Chokkalingam, founder, Equinomics Research & Advisory. “India has and remains a key market for Unilever. But the dynamics here have changed for good. Hence, the indication of weak consumer demand and competitive intensity,” he added.

Apart from small regional players, Hindustan Unilever (HUL), the Indian subsidiary of Unilever, has had to contend with the growing clout of home-grown consumer goods companies, among them Patanjali.

“The number of players it has to deal with now is far more than a decade ago. Existing players have grown in size. Access or availability of products has also grown and price points have fallen in categories like personal care,” said Daljeet Singh Kohli, head of research at brokerage IndiaNivesh.

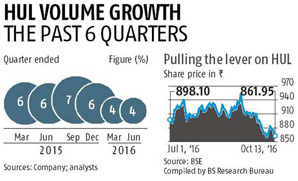

Most analysts have factored in a volume growth of three to four per cent for the September quarter for HUL, in line with what the company reported in the previous two quarters.

But Abneesh Roy, senior vice-president, research, institutional equities, Edelweiss, is optimistic Hindustan Unilever will recover in the fourth quarter. “With sentiment picking up in October-December and some rural momentum because of good rains, the picture should be different in the fourth quarter,” he added.