Is FMCG growth story tapering?

By Dinesh Jain | January 25, 2016

Considered a traditional haven for investors, FMCG has been behaving unlike a defensive category in recent quarters

Last Friday, Kolkata-based ITC reported a marginal increase in third quarter net profit, due to falling cigarette sale volumes and sluggish growth in consumer goods.

Last Friday, Kolkata-based ITC reported a marginal increase in third quarter net profit, due to falling cigarette sale volumes and sluggish growth in consumer goods.This was a week after the results of Hindustan Unilever (HUL), which missed analyst estimates for a third quarter in a row. So, a question now arises: Is there room for growth in fast moving comsumer goods (FMCG).

Considered a traditional haven for investors, FMCG has been behaving unlike a defensive category in recent quarters. Value growth has decreased from five to six per cent in FY15 to about 4.5 per cent now, according to Sanjiv Mehta, managing director at HUL. The pain is expected to last longer, as there are no real triggers of growth in the marketplace, say experts tracking it.

While FMCG volume growth has shown some signs of revival, according to Mehta, at 2.5 to three per cent in FY16 versus nil growth in FY15, this is hardly the comfort level that segment heads seek, experts said.

While FMCG volume growth has shown some signs of revival, according to Mehta, at 2.5 to three per cent in FY16 versus nil growth in FY15, this is hardly the comfort level that segment heads seek, experts said."Even during the 2008 crisis, FMCG delivered double-digit growth. This time, we are seeing a deflationary scenario, triggered by lower commodity prices. While this means our import bill is down, it doesn't augur well from a consumption point of view. If commodity prices are on the lower side for a sustained period, the money in suppliers' hands is lower, this impacts consumption," said G Chokkalingam, founder, Equinomics Research & Advisory.

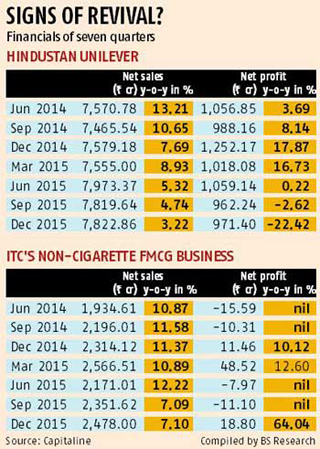

HUL and ITC have not escaped the slowdown. HUL's revenue growth in the past seven quarters has consistently fallen, from 13.2 per cent in the June 2014 one to 3.2 per cent now. ITC's non-cigarette FMCG business has fallen from 11-12 per cent then to seven per cent now (see chart). Both firms are actively looking for triggers outside the traditional organic growth model, experts said. Last month, HUL abandoned its conservative attitude towards mergers and acquisitions (M&A), for instance, acquiring Ayurvedic brand Indulekha in a Rs 330-crore transaction. It was getting back into the M&A market after 12 years.

Similarly, ITC has been acquiring key brands. It acquired B Naturals juice in May 2014 for Rs 100 crore, following with Johnson & Johnson's brands Savlon and Shower to Shower for Rs 180-200 crore in February 2015. Both are expected to continue scouting for acquisitions. "Acquisition is one route that can keep growth going," said Naveen Kulkarni, co-head, research, PhillipCapital, "in a market that is otherwise sluggish".

Acquisition, say experts, is also a crucial lever to prop investor sentiment. Mid-tier firms such as Dabur, Godrej, Emami and Marico, for instance, have used this strategy in the past, improving both turnover and investor sentiment.

HUL, incidentally, also announced last week it was transferring all funds in general reserve into the profit & loss account, triggering speculation of a share buy-back. While a special dividend cannot be ruled out, it is good news for shareholders, say experts.

Advertisement