Knight Frank report finds nearly one-fifth of India’s malls as ghost centres with INR 357 cr potential

By Retail4Growth Bureau | December 09, 2025

According to a retail study by Knight Frank India, 74 out of 365 shopping centres in 32 cities are identified as ghost malls, while top cities like Mysuru and Vadodara are the best-performing shopping centre markets.

Knight Frank India released its flagship retail study, Think India, Think Retail 2025 – Value Capture: Unlocking Potential, mapping India’s retail real estate across 32 cities. The report highlights that nearly one-fifth of operational shopping centres in India are classified as ‘Ghost Malls,’ marked by high vacancies, outdated infrastructure, and underutilised retail potential, which signals a pressing need for revitalisation and strategic interventions in the sector.

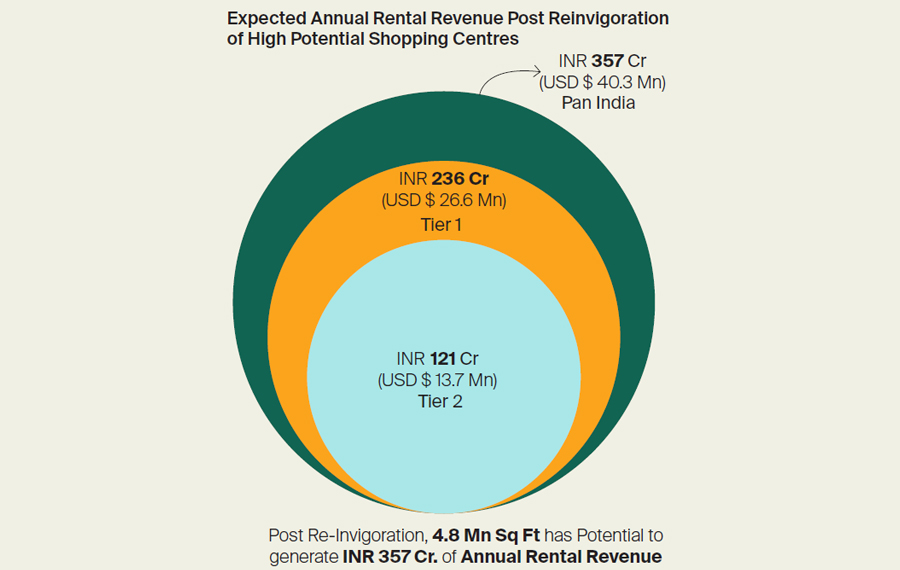

Across 365 shopping centres surveyed, 74 have been classified as ghost assets, representing 15.5 million square feet (mn sq ft) of dormant retail potential. Within this pool, 15 centres with a combined area of 4.8 mn sq ft have been identified as high-potential assets that could deliver as much as INR 357 crore (cr) in annual rental revenues if reinvigorated effectively. Of the 15 shortlisted assets with clear reinvigoration potential, Tier 1 cities hold an opportunity of INR 236 crore in annual rentals, while Tier 2 cities add another INR 121 cr to the reinvigoration landscape.

The study reveals that the ghost mall challenge is not confined to smaller cities or emerging markets. Tier 1 cities account for 11.9 mn sq ft of this dormant stock, indicating that even some of the country’s earliest and most established malls have struggled to keep pace with changing consumer expectations, shifting brand strategies, and the evolution of modern, experience-led retail formats. Tier 2 cities contribute the remaining 3.6 mn sq ft, where operational inefficiencies, inconsistent management practices, and limited anchor presence have restrained shopping centres from reaching their full potential.

“India’s retail sector is entering a defining phase of growth, supported by strong consumption and a clear shift toward high-quality organised retail formats,” said Shishir Baijal, Chairman and Managing Director of Knight Frank India. “Our analysis shows that reinvigorating 4.8 mn sq ft of dormant mall stock could unlock INR 357 cr in annual rentals, which is a substantial opportunity for developers and investors. With Grade A malls operating at only 5.7 per cent vacancy and several Tier 2 cities demonstrating strong absorption trends, the sector is exceptionally well placed for future expansion. As consumer demand evolves and brands scale their footprint, revitalising older centres through redevelopment or adaptive reuse will play a pivotal role in shaping the next chapter of India’s retail transformation.”

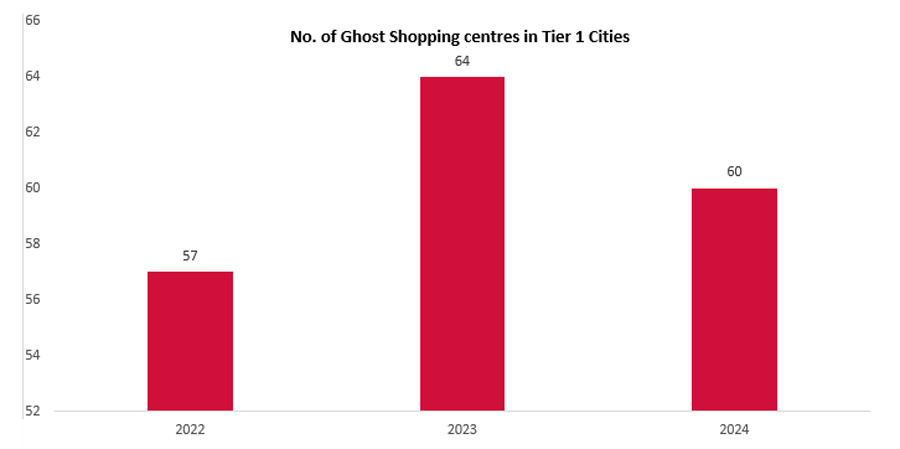

Sizing the Ghost Stock

Identifying ghost shopping centres is essential to unlocking viable reinvigoration opportunities. High vacancies, unstable tenant mixes, outdated layouts, and weak or missing anchor tenants are the clearest signals of an underperforming asset. Grade C malls and older developments, particularly in peripheral locations, are most vulnerable to obsolescence unless repositioned as community hubs, co-working spaces, or mixed-use developments.

Tier 1 cities are beginning to see a decline in ghost shopping centres as redevelopment, new ownership models, design upgrades, and alternate-use conversions bring ageing assets back to life. With rising flexible workspace demand and evolving retail formats, dormant centres are finding renewed relevance. While Grade A malls continue to outperform and lower-grade assets struggle, tightening quality supply is shifting attention to these revitalise-able centres. With focused interventions, improved management, and curated leasing, ghost malls can be repurposed into viable, future-ready assets that support the next phase of India’s retail growth.

Unlocking immediate potential within ghost shopping centres

Of the 365 shopping centres across the top 32 cities, 74 are classified as ghost malls. Within this group, immediate opportunity lies in the 15 centres which alone have the potential to unlock INR 357 cr in annual rentals by reinvigorating 4.8 mn sq ft of dormant space.

Tier 1 cities offer two-thirds of the immediate potential to generate a rental revenue of INR 236 cr, and Tier 2 cities comprise the remaining one-third with INR 121 cr rental revenue. Reviving distressed centres, often at a lower cost than new builds, can rapidly yield healthy, value-added cash flows.

India’s dormant retail infrastructure shows strong reinvigoration potential, especially in ageing but well-located shopping centres. Of the 74 ghost malls identified, 44% lie in the West, aligning with both favourable catchments and revenue potential. The West and South together contribute 77% of the estimated rental opportunity, while the Top 8 metros account for 66% of the INR 357 cr annual potential for 2025. Further, a rental yield of 5.86% makes reinvigoration a compelling investment. With improving connectivity and a shift toward experience-led, mixed-use development, revitalising dormant retail assets is set to drive the next wave of growth.

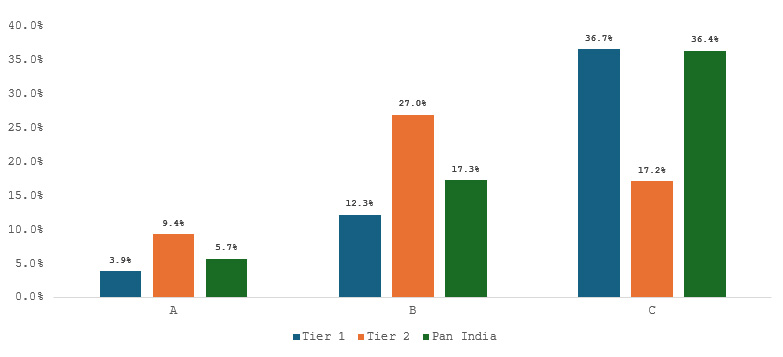

India’s retail real estate is becoming increasingly polarised. While Grade A malls record high occupancy, strong footfalls, and robust brand mixes, ageing and poorly designed centres from the early 2000s face declining relevance due to structural flaws, weak catchment planning, outdated formats, and anchor tenant exits.

Vacancy in Shopping Centres in Top 32 Cities

Shopping Centre Performances across Cities

Across 32 Indian cities, the report reveals a dynamic, yet uneven retail landscape defined by strong demand for quality spaces and widening disparities between Grade A and lower-grade centres. Tier 1 cities account for 73% of India’s shopping centre stock, but several Tier 2 cities such as Mysuru, Vijayawada, Vadodara, Thiruvananthapuram, and Visakhapatnam have performed remarkably with near-full occupancy and balanced tenant mixes, highlighting a growing appetite for organised retail beyond metros.

High-performing Markets based on Vacancy

A handful of cities clearly outperform the rest on key metrics like vacancy. These high achievers generally have retail supply well calibrated to demand, and benefit from proactive centre management.

Mysuru (~2%) has very limited organised space, ensuring high occupancy. Vijayawada (~4%) and Vadodara (~5%) maintain low vacancies through cautious supply. Thiruvananthapuram and Visakhapatnam (~6%) benefit from robust consumer demand and well-managed centres, resulting in consistently high occupancy.

Underperforming Markets based on Vacancy

At the other end of the spectrum, some cities face high vacancies and underutilised malls due to oversupply and planning issues. Nagpur (~49%) has nearly half its space empty, while Amritsar (~41%) and Jalandhar (~34%) suffer from excess centres competing for limited retailers, leading to half-empty properties.

Retail Density

Shopping centre density varies sharply, with cities like Mangaluru (1,521 sq ft/1,000 people) and Lucknow (1,230) showing high penetration, while Pune (1,103) and Bengaluru (1,031) also reflect strong modern retail presence.

In contrast, Surat (118) and Ludhiana (218) have limited mall infrastructure, where traditional formats dominate. Among metros, Mumbai and NCR benefit more from sheer market size than density, while Chennai and Hyderabad exhibit mid-level penetration. These contrasts highlight varied levels of market maturity and distinct opportunities for future retail expansion.

Brand Mix

India’s retail formats differ in brand mix, reflecting shopper expectations. Shopping centres host a balanced 67% Indian and 33% international brands. This makes malls the primary gateways for global retailers entering India. High streets remain predominantly domestic with 86% Indian brands, while airports occupy a middle ground with 70% Indian and 30% international brands. These contrasts highlight how each format supports either global brand penetration or India’s homegrown retail strength.