Split wide open

June 23, 2015

The smart phone market is buzzing with smart deals. But will the consumer call back?

Chinese electronics firm Xiaomi have announced sharp discounts for Mi 4 and Galaxy Grand Max. Another Korean consumer electronics giant, LG invited customers to try out its latest release, the LG G4, a month before the official launch. And Microsoft has been focusing on a digital campaign called #Make it Happen, hoping to woo mobile users in tier-1 and tier-2 towns. As India becomes the fastest growing smart phone market, companies are crowding the marketplace and sharpening their marketing claws.

Chinese electronics firm Xiaomi have announced sharp discounts for Mi 4 and Galaxy Grand Max. Another Korean consumer electronics giant, LG invited customers to try out its latest release, the LG G4, a month before the official launch. And Microsoft has been focusing on a digital campaign called #Make it Happen, hoping to woo mobile users in tier-1 and tier-2 towns. As India becomes the fastest growing smart phone market, companies are crowding the marketplace and sharpening their marketing claws.In over little more than a year, between January 2014 and April this year, the Indian smartphone market has seen 10 new brands and between 500-550 handset upgrades. With huge ad spends, smart digital campaigns and heavy discounts on sales, companies are raising the pitch. Especially as the Chinese market slows down; and International Data Corporation says that India will be the only market to grow in the years till 2019.

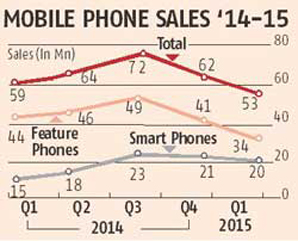

India is now at the same point as the Chinese smartphone market was in 2013. The total Indian mobile handsets market is estimated at 53 million (Q1 2015). The smart phones market is pegged at 19.5 million and accounts for 37 per cent of total mobile sales. However over the first quarter 2015, sales have slowed down. Total mobile sales have come down by 14.5 per cent and smart phone sales by 7 per cent (see table). Still, the major players are undeterred. And Samsung with 27.9 per cent (5.44 million pieces) of the smart phone market, Micromax, 16.2 per cent (3.16 million), Intex, 9.2 per cent (1.8 million) are giving it all they have to get the smart phone users' attention and distinguish themselves from the others.

For example, when LG launched a global campaign for its latest flagship device, it wanted to stand apart from the crowd. It decided to invite tech-savvy users to try out the new phone, a month before the official launch. According to Amit Gujral, marketing head of LG Mobiles India, the participants have a first-hand experience of the smartphone. "We aim to target the tech savvy youth that are always on a look out for great devices to brush up their talents in photography while maintaining the style quotient", Gujral said. The company received thousands of entries from prospective participants. Encouraged by the response, LG India announced a pre-booking offer which included a chance for select few to attend the launch with Amitabh Bachchan on 19 June 2015.

For example, when LG launched a global campaign for its latest flagship device, it wanted to stand apart from the crowd. It decided to invite tech-savvy users to try out the new phone, a month before the official launch. According to Amit Gujral, marketing head of LG Mobiles India, the participants have a first-hand experience of the smartphone. "We aim to target the tech savvy youth that are always on a look out for great devices to brush up their talents in photography while maintaining the style quotient", Gujral said. The company received thousands of entries from prospective participants. Encouraged by the response, LG India announced a pre-booking offer which included a chance for select few to attend the launch with Amitabh Bachchan on 19 June 2015.Given the buzz around launches of new mobile handsets, almost daily, marketers are refining their campaigns in search of an engaged customer base. Some are even co-opting them into the design and product launch process, especially those brands that are targeted at the online buyer. For instance, YU, an online-only brand from Micromax, before the launch of its second handset called YUPHORIA last month, asked consumers to come up with name, design and configurations for the device. It launched #YUNameIT, a campaign which lasted for a week and generated some 1,00,000 responses. This was followed by #YUCreateIt, which asked users to play use the phone to create something new. As a result, the company says it had close to 5,00,000 people pre-booking the phone by May 28 2015. According to Rahul Sharma, founder YU, the company wants to "foster an ecosystem of connected devices that drive individuality driven experiences" by engaging the "neo users and geeks" in the country. All the Yu phone campaigns come with the tagline 'YuplayGod'.

Some companies are looking beyond the metros. Given that the smart phone market in these cities is large and untapped, companies believe this is the best time to build brand loyalty. For instance, Microsoft India has launched a campaign named 'MakeItHappen', which focuses on women from semi-urban and non-metro towns. "They are the protagonists", says Raghuvesh Sarup, director-marketing at Nokia India Sales (a subsidiary of Microsoft Mobile Oy). According to Sarup, although the young women from these towns are not as confident as their urban counterparts, they aspire for and have enough disposable money to switch to smart phones. "We want to target the markets where real India lives", he explained.

Some companies are looking beyond the metros. Given that the smart phone market in these cities is large and untapped, companies believe this is the best time to build brand loyalty. For instance, Microsoft India has launched a campaign named 'MakeItHappen', which focuses on women from semi-urban and non-metro towns. "They are the protagonists", says Raghuvesh Sarup, director-marketing at Nokia India Sales (a subsidiary of Microsoft Mobile Oy). According to Sarup, although the young women from these towns are not as confident as their urban counterparts, they aspire for and have enough disposable money to switch to smart phones. "We want to target the markets where real India lives", he explained.Some companies latched on to the IPL bandwagon to establish their brand. Honor, the online only smart phone from Chinese manufacturer Huawei, tied up with Royal Challengers Bangalore for its 4X range of phones. The company said that its target consumers are "digital natives", a group that lives in the internet, spending more than one-third of their time online. "They are young, vibrant and driven by passion", said Allen Wang, president, consumer business group, Huawei India and Honor. "With this campaign we want to reach out to the youth who are our real ambassadors", Wang added.

As competition gets more intense, companies are bound to get more aggressive with their offers and campaigns. And;customers will get more fickle. A recent report by Business Insider Intelligence shows, the top five vendors in terms of sales changed between 8 different brands in the course of 2014. Brand loyalty comes at a premium and companies are willing to pay the price.

Advertisement