US survey shows 74% of retailers had more budget to invest in store ops this year

By Retail4Growth Team | November 05, 2024

The Store Ops Benchmark Survey conducted by Retail Touchpoints in US points to retailers’ increased thrust on striking a balance between enhancing customer experience on one hand, and boosting profitability by keeping costs down, on the other.

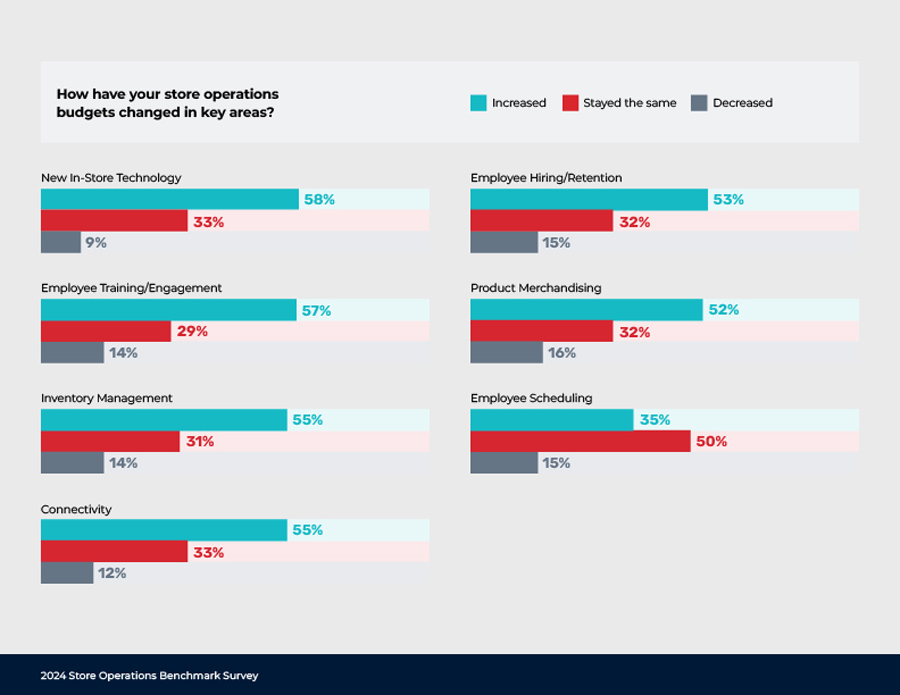

The Store Ops Benchmark Survey titled ‘How Retailers are Doing More with Less’ conducted by Retail Touchpoints in US shows that nearly three-quarters (74%) of retailers had more budget to invest in store operations this year. While the survey is essentially about the US market, it points to an interesting trend that is of relevance to India as well.

According to Retail TouchPoints’ 2024 Store Design & Experience Survey, the top priorities of retailers included:

-

Tackling challenges surrounding associate hiring and retention (69%)

-

Inventory management (60%)

-

Minimizing theft (55%).

“This year’s Store Operations Survey results reaffirm the ongoing tug of war retailers are playing — between providing top-level service on one hand and boosting profitability by keeping costs down on the other. This contest is taking place as retailers also seek to boost store revenues and maintain customer satisfaction — two mandates that put additional pressure on associates and in-store technology,” says the report.

Also, the survey shows that 60% of respondents planned to remodel and renovate at least 11% of their store fleet through 2026.

“To create engaging and resonant environments, retailers need to think about visual aesthetics as well as each store’s functional features and quality of service. As a result, it is not surprising that store conversion rates, year-over-year store revenue and customer satisfaction scores are again the top three metrics that respondents measure,” adds the report.

However, the report adds that merchants are increasingly looking at user-generated feedback and consumer outreach to identify trends in store experience and prioritize areas of improvement.

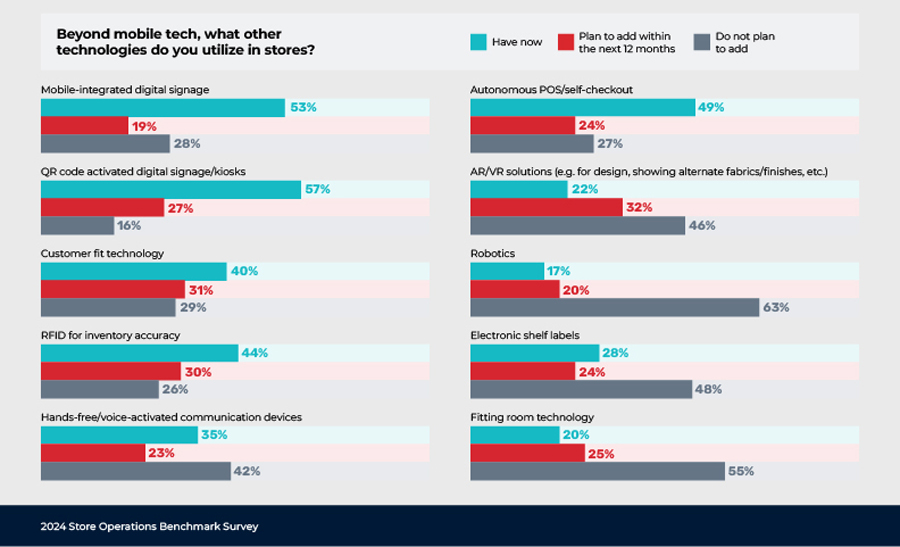

The report adds that retailers’ focus on store-level productivity and performance carries through to other in-store technology decisions. “QR code-activated digital signage and kiosks, as well as mobile-integrated digital signage and autonomous POS/self-checkout, all are designed to give in-store shoppers a level of control over their experience. Rather than relying on store associates to provide product-level details and even complete transactions, consumers can use this tech to do it themselves. Looking forward over the next 12 months, this focus on customer empowerment will continue, with retailers saying they plan to invest in AR/VR solutions (32%), customer fit technology (31%) and RFID (30%), which not only helps ensure inventory accuracy but can power invaluable in-store tech,” says the report.

_sunrise_140_270.jpg)