Customer centricity key to retail banks’ growth, says study

By Retail4Growth Team |

July 17, 2019

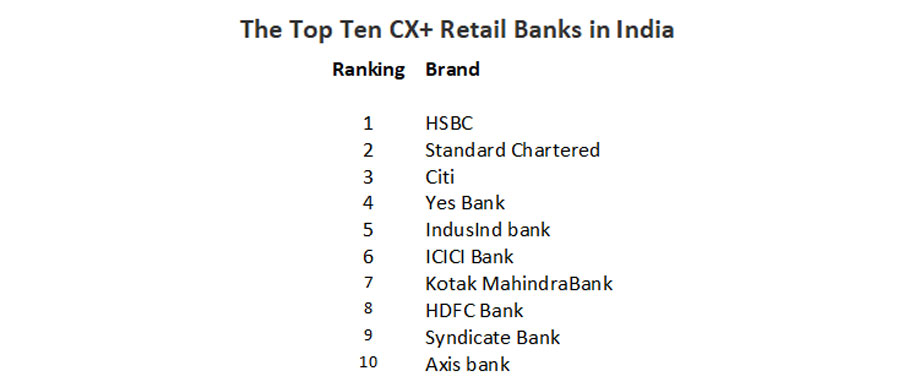

According to a Kantar CX+ study, 91% of retail bank CEOs in India see the need to become customer-centric, and just 29% of consumers believe banks offer truly customer-centric experiences.

The new CX+ study released by Kantar reveals the importance of being customer centric for driving business growth in today’s experience era. 91% of retail bank CEOs in India see the need to become customer-centric, just 29% of consumers believe banks offer truly customer-centric experiences, according to Kantar CX+ study.

The new study is the only sector-specific index that assesses banks based on a unique combination of their customer experience scores. In addition, the study identifies each bank’s Experience Gap – which quantifies the difference between their Brand Promise and the actual customer experience delivered.

CX+ reflects that providing excellent customer experiences is no longer enough. Thus the roadmap to growth is based on 5 key CX success factors:

1. Clarity of brand promise

2. Empowered employees

3. Empowered customers

4. Creating lasting memories

5. Exceptional delivery

Commenting on the launch of the findings and CX+ ranking, Preeti Reddy, CEO-South Asia, Insights Division, Kantar said: “We live in the age of experience, but many brands are still missing the mark as there’s a huge gap between brand promise and customer experience. Our study reveals that the top-ranking Retail banks in India have delivered a superior customer experience that is matched with a strong brand promise thus giving them a distinctive. However, there’s a huge opportunity for growth as half of India is still unbanked and are increasingly looking up to their banks to give them more personalized experiences."

The Kantar CX+ study analyzed 7,280 retail banking customers in India and was conducted in 2019.

Comments