Family entertainment centres to reach $ 40,814 million by 2025, says study

By Retail4Growth Team | July 22, 2019

According to a report by Allied Market Research, Family entertainment centres will grow at a CAGR of 10.2% from 2018 to 2025.

As per a new report by Allied Market Research, the global family/indoor entertainment centres market size, which was valued at $18,907 million in 2017, is projected to reach $ 40,814 million by 2025, growing at a CAGR of 10.2% from 2018 to 2025. The family/indoor entertainment centres (FECs) are small amusement parks or entertainment zones that typically serve local communities in big and small cities.

As per a new report by Allied Market Research, the global family/indoor entertainment centres market size, which was valued at $18,907 million in 2017, is projected to reach $ 40,814 million by 2025, growing at a CAGR of 10.2% from 2018 to 2025. The family/indoor entertainment centres (FECs) are small amusement parks or entertainment zones that typically serve local communities in big and small cities.

The entry fees and ticket sales segment dominated the overall family/indoor entertainment centres market share in 2017 and is expected to continue this trend during the forecast period. However, the food & beverage segment is expected to witness highest growth, due to increase in availability of different food options for kids as well as adults. Moreover, people also prefer family/indoor entertainment centres as locations of choice for corporate parties and birthday parties for children as well as adults. This trend increases revenue generation from the food & beverage sector in the FECs.

The report focuses on the growth prospects, restraints, and trends of the global family/indoor entertainment centers market. The study provides family/indoor entertainment centers market analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the growth of the family/indoor entertainment centers market.

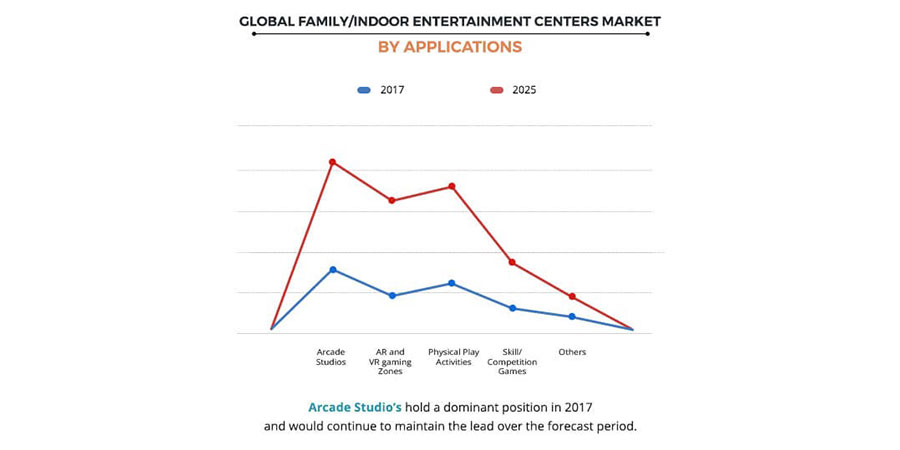

Segment review

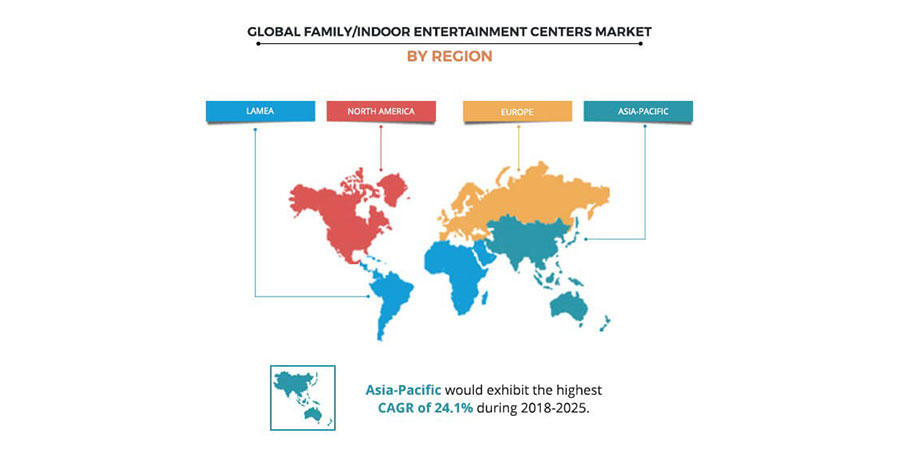

The global family/indoor entertainment centres market is segmented based on visitor demographics, facility size, revenue source, application, type, and region. In terms of visitor demographics, the market is categorized into (Families with Children (0-8), families with children (9-12), teenagers (13-19), young adults (20-25), and adults (Ages 25+). Based on facility size, it is divided into up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 10 to 30 acres, and over 30 acres. Based on revenue source, it is classified into entry fees & ticket sales, food & beverages, merchandising, advertisement, and others. Family/Indoor Entertainment Centers Market application includes arcade studios, AR and VR gaming zones, physical play activities, skill/competition games, and others. Based on type, the market is divided into children’s entertainment centres (CECs), children’s edutainment centres (CEDCs), adult entertainment centres (AECs), and Location-based VR Entertainment Centres (LBECs) . Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Top impacting factors

Growth in per capita disposable income, availability of diversified gaming and entertainment options, and favorable youth demographics in the Asia-Pacific region drive growth of the family/indoor entertainment centers market. However, home gaming and mobile devices, high initial cost, and increase in ticket prices are the factors expected to hamper the growth of the market during the forecast period. Furthermore, continuous launch of new FECs supporting family activities, F&B integration, and participatory play, substantial growing investments by malls in the Asia-Pacific region and integration of new technologies such as virtual reality gaming, 3D technology, and others provide opportunities for the growth of the market.

Favorable youth demographics

Favorable youth demographics

FECs usually appeal to the 8 to 14 age group and their parents. The median age in many Asian countries is in the 20s and early 30s. This indicates penetration of deep youth population under the age of 14 in the Asia-Pacific region and with rising incomes and expectations, parents are spending more on their children, which is expected to drive the family/indoor entertainment centres market growth. Compared to the median age in the 20s in countries such as Malaysia and the Philippines, against median ages in the 40s in developed nations such as Germany or the U.S., the Family/indoor entertainment centers market is expected to experience substantial growth in the Asia-Pacific region.

Continuous launch of new FECs supporting family activities, F&B integration, and participatory play

Indoor parks are both within greater reach and more profitable to most developers and operators as compared to outdoor theme parks due to which number of operators are launching new FEC’s to attract the customers. For outdoor theme parks, profits per visitor can range from $5 to $200. At the same time, however, development costs can be between $100 and $600+ per annual visitor. For indoor parks, while average profits per visitor are lower, at between $5 and $40, development costs also bound in a lower range, at between $30 and $100 per visitor. These economics arise because of the constrained nature of ticket prices versus the relatively unconstrained and high costs of development. It is difficult to justify paying more than $50 to $100 for an attraction. In addition, outdoor theme parks are sizable as well as land and infrastructure costs can be astronomical due to which there is a continuous rise in the popularity of indoor theme parks which is a major family/indoor entertainment centres market opportunity. Furthermore, operators are launching FEC’s, which support family activities, F&B integration, and participatory play to differentiate themselves from their competitors. This fuels the growth of the market. For instance, a growing set of developers and operators such as Dreamplay in Malaysia and Sports Monster in Korea have targeted more active, kinetic activities as a point of differentiation.

Increase in ticket prices

There is a constant increase in the ticket prices of family/indoor entertainment centers owing to various economic factors. Also, the price of the ticket differs based on the location of the FEC’s. This is a major factor that hampers the growth of the FEC market during the forecast period. The industry is facing stagnation in terms of income of the middle class population. This is expected to affect consumer spending on family/indoor entertainment centers.

For more updates, subscribe to retail4growth newsletter - Click here

Comments