Propping Up The Retail Experience!

By Satarupa Chakraborty | August 28, 2018

Once perceived as a passive component in the design narrative, retail props have now become an integral part of the design and planning process. VM&RD analyses the key trends with some significant findings in the VM and props industry.

As retail store environment is taking a more experiential form and updated visual merchandising schemes are becoming imperative retailing requirement, like any retail design and VM element, the use of props has become critical. What was earlier perceived as the most passive component in the design narrative, is now often part of the design and planning process.

As retail store environment is taking a more experiential form and updated visual merchandising schemes are becoming imperative retailing requirement, like any retail design and VM element, the use of props has become critical. What was earlier perceived as the most passive component in the design narrative, is now often part of the design and planning process.

Reduced Permanent Props, Increased VM Props

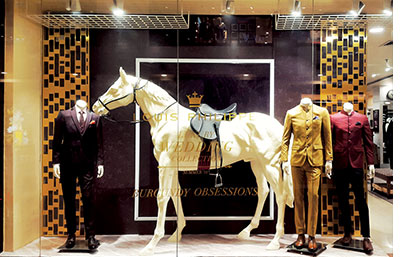

As brands and retailers are innovating their retail design ID perpetually, clean design lines and better accessibility are top requirements. Therefore, many new design IDs are reducing the use of permanent props. Brands like Van Heusen, Louis Phillippe, Bata and Blackberrys are some of the latest ones to have drastically reduce their line of props and have placed props only at dedicated display areas, while avoiding them at customer access points. Permanent props are often functional and the trend is inspiring props such as collars stand, socks stand, shoe display stands etc.  Interestingly, while apparel brands are moving away from heavy use of permanent props, lifestyle, automobile and other categories of brands are often embracing the use of props to heighten the store experiences.

Interestingly, while apparel brands are moving away from heavy use of permanent props, lifestyle, automobile and other categories of brands are often embracing the use of props to heighten the store experiences.

On the other hand, as the refreshment of visual merchandising is more frequent throughout the year, the use of VM props is on a perpetual high. In this, kinetic and animated props and life-size props are also gaining popularity. LFS formats like Lifestyle, in their last few seasons, have extensively experimented with kinetic props for both their seasonal and secondary windows. Home furnishing and décor format from Landmark Group, Home Centre, had gone overboard with kinetic props in their festive and other windows lately.

Customised Design And Quality

Much like the global trend, VM schemes in India is often deployed with the soul purpose of storytelling. The use of permanent props  are also strategic and often striking to evoke the same thought of storytelling. This also means a surge in innovative and customised props. The use of props imported from China, which was a common phenomenon in the props industry even a few years back, has been reduced to a mere 10-15% of the total usage. Topline props makers in the country like Delhi-based HG Graphics etc are also moving towards 3D printing, which delivers exact shapes and dimensions. When British luxury brand Simon Carter debuted their store format in India last year, the designer’s dog Grevaise had to sit at the store as a prop and only 3D printing could deliver the effect. The upcoming MBO project by the Reliance Brands Ltd, White Crow, is believed to showcase a premium line of props, which

are also strategic and often striking to evoke the same thought of storytelling. This also means a surge in innovative and customised props. The use of props imported from China, which was a common phenomenon in the props industry even a few years back, has been reduced to a mere 10-15% of the total usage. Topline props makers in the country like Delhi-based HG Graphics etc are also moving towards 3D printing, which delivers exact shapes and dimensions. When British luxury brand Simon Carter debuted their store format in India last year, the designer’s dog Grevaise had to sit at the store as a prop and only 3D printing could deliver the effect. The upcoming MBO project by the Reliance Brands Ltd, White Crow, is believed to showcase a premium line of props, which  are next-to-real and are being developed through the same printing and manufacturing process.

are next-to-real and are being developed through the same printing and manufacturing process.

The need to service a diverse group of brands and categories has enabled the development of skills and infrastructure to customise in short cycles. While majority is props players still don’t have the facility of 3D printing, they can no longer produce flat props. While fiberglass is the preferred material for most premium line of props, materials like wood, metal, foam, leatherite etc are fast entering the world of props. However, the need for skilled manpower is still a challenge in this industry as each project is unique and may require multiple processes and materials along with various needs of  workmanship. It’s interesting to note that, unlike any other elements of retail design, props is the only industry that requires maximum amount of human intervention. Given the high level of accuracy in delivery, many vendors have reported 18-20% of wastage and need for extra stocking to match the parameters.

workmanship. It’s interesting to note that, unlike any other elements of retail design, props is the only industry that requires maximum amount of human intervention. Given the high level of accuracy in delivery, many vendors have reported 18-20% of wastage and need for extra stocking to match the parameters.

Local Sourcing And Mixed Suppliers

The props industry in this country is quite young with over 88% being under 10 years of existence. The remaining 12% has entered this domain only in the last one decade. This data also indicates that most of the props players are coming from associated trades.  Top retail props makers have robust background as either signage or as mannequin manufacturers. The growth of the industry is very healthy at 28% owing to the high demand compared to shortage of supply. Top 25 players of the props industry are servicing over 800 clients with an average of about 34 clients each with the top 4 players servicing a challenging 100 clients. Given the diverse quality and design that each brand demands, this data looks quite amazing. If we look at the clients’ side, 68% of the clientele are from apparel category while rest is from non-apparel. Taking top 25 players into account, 20% of the players are exporting on an average 14% of their annual production, which also indicates that some of the top line manufacturers are ready to compete with the global standard. While markets like Poland and Russia are at the helm of high quality of retail props, Indian vendors are surely inching towards perfection.

Top retail props makers have robust background as either signage or as mannequin manufacturers. The growth of the industry is very healthy at 28% owing to the high demand compared to shortage of supply. Top 25 players of the props industry are servicing over 800 clients with an average of about 34 clients each with the top 4 players servicing a challenging 100 clients. Given the diverse quality and design that each brand demands, this data looks quite amazing. If we look at the clients’ side, 68% of the clientele are from apparel category while rest is from non-apparel. Taking top 25 players into account, 20% of the players are exporting on an average 14% of their annual production, which also indicates that some of the top line manufacturers are ready to compete with the global standard. While markets like Poland and Russia are at the helm of high quality of retail props, Indian vendors are surely inching towards perfection.

Given the international standards, brands like Tommy Hilfiger and Calvin Klein, once importing their props from abroad, now work with Indian vendors, while brands like Jack & Jones and Inditex brands are yet to find confidence in them.

Dearth Of Re-Use Strategies

While major global retailers are focusing on reusing the redundant line of props and mannequins, Indian retailers, even with their sharp cost-cutting measures, virtually have no strategy to save props from turning into trash. Almost all brands and retailers in the country are throwing their seasonal props or selling them to scrap-sellers. However, there have been marginal efforts from some of them to choose eco-friendly materials so that they don’t harm environment even when discarded.

Interestingly, we came across some vendors thinking in these lines. Delhi-based VM agency, Few Steps Ahead, with many celebrated VM schemes to their credit, have started re-utilising the props by donating them to schools and institutional projects, though the bandwidth is very small at this moment. In another effort, Delhi-based 3S Mannequins, which came lately into props business, is giving freehand to retailers to sell those props off-the-shelf after they are no longer in use.

Propping Ahead

Though we see reduction in permanent propping owing to cost-cutting and clean design lines, there has been an upsurge in the use of VM props. Premium brands are still opting for quality props. All in all, the demand is on rise, specially for the fact that the vendors are still limited in number. The total revenue generated by top 25 prop vendors is over INR100 crore with the average of each being a low INR5 crore through the top players are over about 3 times that average. This clearly shows adequate demand and therefore, more rooms to welcome more players.

Source: VMRD Survey, 2017

Images courtesy : Being Human, Central, HG Graphics, Louis Philippe, Kompanero, Woods