FMCG companies buck slowdown trend in Q3

By Dinesh Jain | Vjmedia Works | January 28, 2014

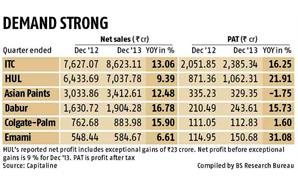

Results declared so far point to a decent show on volumes & margins

The December 2013 quarter

seems to have turned out to be good for fast-moving consumer goods (FMCG) companies. Barring Kolkata-based Emami, which posted volume growth of 1.5 per cent for its

domestic business (which makes up over 80 per cent of its consolidated

revenues), most others were on safe ground.

The December 2013 quarter

seems to have turned out to be good for fast-moving consumer goods (FMCG) companies. Barring Kolkata-based Emami, which posted volume growth of 1.5 per cent for its

domestic business (which makes up over 80 per cent of its consolidated

revenues), most others were on safe ground.

Consider this: Hindustan Unilever (HUL), India's largest FMCG company, reported a 9.4 per cent

growth in top line, led by a 10 per cent expansion each in foods and home &

personal care. While volume growth was four per cent in the December quarter,

compared to five per cent in the September quarter, it was largely in line with

Street estimates of four-five per cent growth. Profit growth (before

exceptional items) was nine per cent, which was ahead of Street estimates of

seven to eight per cent.

Thanks to these numbers, HUL's stock touched Rs 584.40 a unit on the BSE exchange in a weak market, following announcement of

the results after 3 pm on Monday. It closed trade at Rs 575.55 a share, up two

per cent over the previous close.

HUL wasn't the only one to bring smiles to investors and allied stakeholders.

Oral care giant Colgate saw an 11 per cent volume growth in toothpaste, 13

per cent in mouthwash and 22 per cent in toothbrush for the quarter. Asian Paints posted an eight per cent growth in volume

sales in its key decorative business slightly below Street estimates of 10 per

cent but still not dramatically down, given the weak consumer sentiment that

marred the paints business during the festive quarter.

Ghaziabad-headquartered Dabur, which declared its numbers last week, maintained

volume growth levels at nine per cent, something it had achieved in the

September 2013 quarter as well.

On the other hand, Kolkata-based ITC managed to curb the impact on volume

growth in cigarettes due to persistent price rises, reporting a two per cent

decline in the December quarter in comparison to four per cent in the September

quarter. More important, ITC's other FMCG business comprising personal care and

foods grew 16.6 per cent in terms of revenues during the quarter, becoming

profitable for the second time after consecutive quarters of losses.

While ad spending remained high, most companies barring Colgate and Dabur

expanded their operating margins on the back of benign input costs. HUL, for

instance, saw operating margins expand by 51 basis points, led in part by a

gross margin expansion of 114 basis points. ITC's operating margins were flat

but analysts say this could have declined if gross margins hadn't expanded by

70 basis points. Emami saw gross margins move up nearly 300 basis points,

thanks to prices of inputs such as mentha oil dipping, which helped the company

improve operating margins by 527 basis points during the quarter. Emami also

benefited from lower ad spending, down nearly 360 basis points during the

quarter.

Launches helped

Abneesh Roy, associate director, research, institutional equities, Edelweiss,

says: "All those companies which were proactive and innovative during the

quarter have bucked the slowdown trend. ITC, for instance, have seen growth in

both personal care and foods during the December quarter driven by a steady

stream of launches, innovations and aggressive advertising. I expect ITC to

sustain this momentum in the fourth quarter as well."

Colgate, in contrast, grew amid stiff competition from GlaxoSmithKline

Consumer, HUL and Procter & Gamble, which not only launched new products

but also increased ad spending in a bid to grab share.

Using a combination of tactics from expanding distribution reach into tier-II

and tier-III cities, launching smaller packs of toothpaste in rural areas to

stepping into niche categories, Colgate did everything to grow market share,

says Vivek Veda, analyst (consumer and retail) at Espirito Santo Securities.

Veda points out Colgate's market share for the December quarter stood at 56 per

cent, higher than the previous quarter's 54.6 per cent. In the brush segment,

Colgate maintained market share levels at 41.5 per cent in line with September

quarter numbers.

HUL, in contrast, delivered double-digit growth in personal products (12.4 per

cent) and packaged foods (12.9 per cent) and single-digit growth in soaps and

detergents (7.1 per cent) and beverages (7.2 per cent). However, HUL's Chief

Financial Officer R Sridhar attributes the single-digit growth in soaps &

detergents and beverages to high penetration levels of the two segments. "There

has been no downtrading in these segments. Instead, categories such as tea have

seen growth at the mass, mid and premium ends of the market, which is a good

sign,†Sridhar adds.